estimate

Fit vector error-correction (VEC) model to data

Syntax

Description

EstMdl = estimate(Mdl,Tbl1)Mdl to variables

in the input table or timetable Tbl1, which contains time

series data, and returns the fully specified, estimated VEC(p

– 1) model EstMdl. estimate selects

the variables in Mdl.SeriesNames or all variables in

Tbl1. To select different variables in

Tbl1 to fit the model to, use the

ResponseVariables name-value argument. (since R2022b)

[

returns the estimated, asymptotic standard errors of the estimated parameters EstMdl,EstSE,logL,Tbl2] = estimate(Mdl,Tbl1)EstSE, the optimized loglikelihood objective function value logL, and the table or timetable Tbl2 of all variables in Tbl1 and residuals corresponding to the response variables to which the model is fit (ResponseVariables). (since R2022b)

[___] = estimate(___,

specifies options using one or more name-value arguments in

addition to any of the input argument combinations in previous syntaxes.

Name,Value)estimate returns the output argument combination for the

corresponding input arguments. For example, estimate(Mdl,Y,Model="H1*",X=Exo)

fits the VEC(p – 1) model Mdl to the

matrix of response data Y, and specifies the H1* Johansen

form of the deterministic terms and the matrix of exogenous predictor data

Exo.

Supply all input data using the same data type. Specifically:

If you specify the numeric matrix

Y, optional data sets must be numeric arrays and you must use the appropriate name-value argument. For example, to specify a presample, set theY0name-value argument to a numeric matrix of presample data.If you specify the table or timetable

Tbl1, optional data sets must be tables or timetables, respectively, and you must use the appropriate name-value argument. For example, to specify a presample, set thePresamplename-value argument to a table or timetable of presample data.

Examples

Fit a VEC(1) model to seven macroeconomic series. Supply the response data as a numeric matrix.

Consider a VEC model for the following macroeconomic series:

Gross domestic product (GDP)

GDP implicit price deflator

Paid compensation of employees

Nonfarm business sector hours of all persons

Effective federal funds rate

Personal consumption expenditures

Gross private domestic investment

Suppose that a cointegrating rank of 4 and one short-run term are appropriate, that is, consider a VEC(1) model.

Load the Data_USEconVECModel data set.

load Data_USEconVECModelFor more information on the data set and variables, enter Description at the command line.

Determine whether the data needs to be preprocessed by plotting the series on separate plots.

figure tiledlayout(2,2) nexttile plot(FRED.Time,FRED.GDP); title("Gross Domestic Product"); ylabel("Index"); xlabel("Date"); nexttile plot(FRED.Time,FRED.GDPDEF); title("GDP Deflator"); ylabel("Index"); xlabel("Date"); nexttile plot(FRED.Time,FRED.COE); title("Paid Compensation of Employees"); ylabel("Billions of $"); xlabel("Date"); nexttile plot(FRED.Time,FRED.HOANBS); title("Nonfarm Business Sector Hours"); ylabel("Index"); xlabel("Date");

figure tiledlayout(2,2) nexttile plot(FRED.Time,FRED.FEDFUNDS) title("Federal Funds Rate") ylabel("Percent") xlabel("Date") nexttile plot(FRED.Time,FRED.PCEC) title("Consumption Expenditures") ylabel("Billions of $") xlabel("Date") nexttile plot(FRED.Time,FRED.GPDI) title("Gross Private Domestic Investment") ylabel("Billions of $") xlabel("Date")

Stabilize all series, except the federal funds rate, by applying the log transform. Scale the resulting series by 100 so that all series are on the same scale.

FRED.GDP = 100*log(FRED.GDP); FRED.GDPDEF = 100*log(FRED.GDPDEF); FRED.COE = 100*log(FRED.COE); FRED.HOANBS = 100*log(FRED.HOANBS); FRED.PCEC = 100*log(FRED.PCEC); FRED.GPDI = 100*log(FRED.GPDI);

Create a VEC(1) model using the shorthand syntax. Specify the variable names.

Mdl = vecm(7,4,1); Mdl.SeriesNames = FRED.Properties.VariableNames

Mdl =

vecm with properties:

Description: "7-Dimensional Rank = 4 VEC(1) Model with Linear Time Trend"

SeriesNames: "GDP" "GDPDEF" "COE" ... and 4 more

NumSeries: 7

Rank: 4

P: 2

Constant: [7×1 vector of NaNs]

Adjustment: [7×4 matrix of NaNs]

Cointegration: [7×4 matrix of NaNs]

Impact: [7×7 matrix of NaNs]

CointegrationConstant: [4×1 vector of NaNs]

CointegrationTrend: [4×1 vector of NaNs]

ShortRun: {7×7 matrix of NaNs} at lag [1]

Trend: [7×1 vector of NaNs]

Beta: [7×0 matrix]

Covariance: [7×7 matrix of NaNs]

Mdl is a vecm model object. All properties containing NaN values correspond to parameters to be estimated given data.

Estimate the model using the entire data set and the default options.

EstMdl = estimate(Mdl,FRED.Variables)

EstMdl =

vecm with properties:

Description: "7-Dimensional Rank = 4 VEC(1) Model"

SeriesNames: "GDP" "GDPDEF" "COE" ... and 4 more

NumSeries: 7

Rank: 4

P: 2

Constant: [14.1329 8.77841 -7.20359 ... and 4 more]'

Adjustment: [7×4 matrix]

Cointegration: [7×4 matrix]

Impact: [7×7 matrix]

CointegrationConstant: [-28.6082 -109.555 77.0912 ... and 1 more]'

CointegrationTrend: [4×1 vector of zeros]

ShortRun: {7×7 matrix} at lag [1]

Trend: [7×1 vector of zeros]

Beta: [7×0 matrix]

Covariance: [7×7 matrix]

EstMdl is an estimated vecm model object. It is fully specified because all parameters have known values. By default, estimate imposes the constraints of the H1 Johansen VEC model form by removing the cointegrating trend and linear trend terms from the model. Parameter exclusion from estimation is equivalent to imposing equality constraints to zero.

Display a short summary from the estimation.

results = summarize(EstMdl)

results = struct with fields:

Description: "7-Dimensional Rank = 4 VEC(1) Model"

Model: "H1"

SampleSize: 238

NumEstimatedParameters: 112

LogLikelihood: -1.4939e+03

AIC: 3.2118e+03

BIC: 3.6007e+03

Table: [133×4 table]

Covariance: [7×7 double]

Correlation: [7×7 double]

The Table field of results is a table of parameter estimates and corresponding statistics.

Consider the model and data in Fit VEC(1) Model to Matrix of Response Data, and suppose that the estimation sample starts at Q1 of 1980.

Load the Data_USEconVECModel data set and preprocess the data.

load Data_USEconVECModel

FRED.GDP = 100*log(FRED.GDP);

FRED.GDPDEF = 100*log(FRED.GDPDEF);

FRED.COE = 100*log(FRED.COE);

FRED.HOANBS = 100*log(FRED.HOANBS);

FRED.PCEC = 100*log(FRED.PCEC);

FRED.GPDI = 100*log(FRED.GPDI);Identify the index corresponding to the start of the estimation sample.

estIdx = FRED.Time(2:end) > '1979-12-31';Create a default VEC(1) model using the shorthand syntax. Assume that the appropriate cointegration rank is 4. Specify the variable names.

Mdl = vecm(7,4,1); Mdl.SeriesNames = FRED.Properties.VariableNames;

Estimate the model using the estimation sample. Specify all observations before the estimation sample as presample data. Also, specify estimation of the H Johansen form of the VEC model, which includes all deterministic parameters.

Y0 = FRED{~estIdx,:};

EstMdl = estimate(Mdl,FRED{estIdx,:},'Y0',Y0,'Model',"H")EstMdl =

vecm with properties:

Description: "7-Dimensional Rank = 4 VEC(1) Model with Linear Time Trend"

SeriesNames: "GDP" "GDPDEF" "COE" ... and 4 more

NumSeries: 7

Rank: 4

P: 2

Constant: [17.5698 3.74759 -20.1998 ... and 4 more]'

Adjustment: [7×4 matrix]

Cointegration: [7×4 matrix]

Impact: [7×7 matrix]

CointegrationConstant: [-85.4825 -57.3569 81.7344 ... and 1 more]'

CointegrationTrend: [0.0264185 -0.00275396 0.0249583 ... and 1 more]'

ShortRun: {7×7 matrix} at lag [1]

Trend: [0.000514564 -0.000291183 0.00179965 ... and 4 more]'

Beta: [7×0 matrix]

Covariance: [7×7 matrix]

Because the VEC model order p is 2, estimate uses only the last two observations (rows) in Y0 as a presample.

Since R2022b

Fit a VEC(1) model to seven macroeconomic series. Supply a timetable of data and specify the series for the fit. This example is based on Fit VEC(1) Model to Matrix of Response Data.

Load and Preprocess Data

Load the Data_USEconVECModel data set.

load Data_USEconVECModel

head(FRED) Time GDP GDPDEF COE HOANBS FEDFUNDS PCEC GPDI

___________ _____ ______ _____ ______ ________ _____ ____

31-Mar-1957 470.6 16.485 260.6 54.756 2.96 282.3 77.7

30-Jun-1957 472.8 16.601 262.5 54.639 3 284.6 77.9

30-Sep-1957 480.3 16.701 265.1 54.375 3.47 289.2 79.3

31-Dec-1957 475.7 16.711 263.7 53.249 2.98 290.8 71

31-Mar-1958 468.4 16.892 260.2 52.043 1.2 290.3 66.7

30-Jun-1958 472.8 16.94 259.9 51.297 0.93 293.2 65.1

30-Sep-1958 486.7 17.043 267.7 51.908 1.76 298.3 72

31-Dec-1958 500.4 17.123 272.7 52.683 2.42 302.2 80

Stabilize all series, except the federal funds rate, by applying the log transform. Scale the resulting series by 100 so that all series are on the same scale.

FRED.GDP = 100*log(FRED.GDP); FRED.GDPDEF = 100*log(FRED.GDPDEF); FRED.COE = 100*log(FRED.COE); FRED.HOANBS = 100*log(FRED.HOANBS); FRED.PCEC = 100*log(FRED.PCEC); FRED.GPDI = 100*log(FRED.GPDI); numobs = height(FRED)

numobs = 240

Prepare Timetable for Estimation

When you plan to supply a timetable directly to estimate, you must ensure it has all the following characteristics:

All selected response variables are numeric and do not contain any missing values.

The timestamps in the

Timevariable are regular, and they are ascending or descending.

Remove all missing values from the table.

DTT = rmmissing(FRED); numobs = height(DTT)

numobs = 240

DTT does not contain any missing values.

Determine whether the sampling timestamps have a regular frequency and are sorted.

areTimestampsRegular = isregular(DTT,"quarters")areTimestampsRegular = logical

0

areTimestampsSorted = issorted(DTT.Time)

areTimestampsSorted = logical

1

areTimestampsRegular = 0 indicates that the timestamps of DTT are irregular. areTimestampsSorted = 1 indicates that the timestamps are sorted. Macroeconomic series in this example are timestamped at the end of the month. This quality induces an irregularly measured series.

Remedy the time irregularity by shifting all dates to the first day of the quarter.

dt = DTT.Time; dt = dateshift(dt,"start","quarter"); DTT.Time = dt; areTimestampsRegular = isregular(DTT,"quarters")

areTimestampsRegular = logical

1

DTT is regular with respect to time.

Create Model Template for Estimation

Create a VEC(1) model using the shorthand syntax. Specify the variable names.

Mdl = vecm(7,4,1); Mdl.SeriesNames = FRED.Properties.VariableNames

Mdl =

vecm with properties:

Description: "7-Dimensional Rank = 4 VEC(1) Model with Linear Time Trend"

SeriesNames: "GDP" "GDPDEF" "COE" ... and 4 more

NumSeries: 7

Rank: 4

P: 2

Constant: [7×1 vector of NaNs]

Adjustment: [7×4 matrix of NaNs]

Cointegration: [7×4 matrix of NaNs]

Impact: [7×7 matrix of NaNs]

CointegrationConstant: [4×1 vector of NaNs]

CointegrationTrend: [4×1 vector of NaNs]

ShortRun: {7×7 matrix of NaNs} at lag [1]

Trend: [7×1 vector of NaNs]

Beta: [7×0 matrix]

Covariance: [7×7 matrix of NaNs]

Fit Model to Data

Estimate the model. Pass the entire timetable DTT. By default, estimate selects the response variables in Mdl.SeriesNames to fit to the model. Alternatively, you can use the ResponseVariables name-value argument.

Return the timetable of residuals and data fit to the model.

[EstMdl,~,~,Tbl2] = estimate(Mdl,DTT);

EstMdl is an estimated vecm model object. It is fully specified because all parameters have known values.

Display the head of the table Tbl2.

head(Tbl2)

Time GDP GDPDEF COE HOANBS FEDFUNDS PCEC GPDI GDP_Residuals GDPDEF_Residuals COE_Residuals HOANBS_Residuals FEDFUNDS_Residuals PCEC_Residuals GPDI_Residuals

___________ ______ ______ ______ ______ ________ ______ ______ _____________ ________________ _____________ ________________ __________________ ______________ ______________

01-Jul-1957 617.44 281.55 558.01 399.59 3.47 566.71 437.32 0.12076 0.090979 -0.31114 -0.47341 -0.013177 0.14899 1.1764

01-Oct-1957 616.48 281.61 557.48 397.5 2.98 567.26 426.27 -2.4005 -0.39287 -2.1158 -2.1552 -0.86464 -0.89017 -12.289

01-Jan-1958 614.93 282.68 556.15 395.21 1.2 567.09 420.02 -2.0142 0.92195 -1.5874 -1.1852 -1.3247 -0.72797 -4.4964

01-Apr-1958 615.87 282.97 556.03 393.76 0.93 568.09 417.59 0.2131 -0.39586 -0.22658 -0.070487 -0.24993 0.17697 -0.31486

01-Jul-1958 618.76 283.57 558.99 394.95 1.76 569.81 427.67 2.0866 0.45876 2.4738 1.9098 0.98197 1.0195 9.119

01-Oct-1958 621.54 284.04 560.84 396.43 2.42 571.11 438.2 0.68671 0.053454 0.48556 0.63518 0.23659 -0.21548 4.2428

01-Jan-1959 623.66 284.31 563.55 398.35 2.8 573.62 442.12 0.39546 -0.066055 0.97292 1.0224 -0.054929 0.86153 0.68805

01-Apr-1959 626.19 284.46 565.91 400.24 3.39 575.54 449.31 0.24314 -0.22217 0.33889 0.4216 -0.20457 0.26963 -0.15985

Because Mdl.P is 2, estimation requires two presample observations. Consequently, estimate uses the first two rows (first two quarters of 1957) of DTT as a presample, fits the model to the remaining observations, and returns only those observations used in estimation in Tbl2.

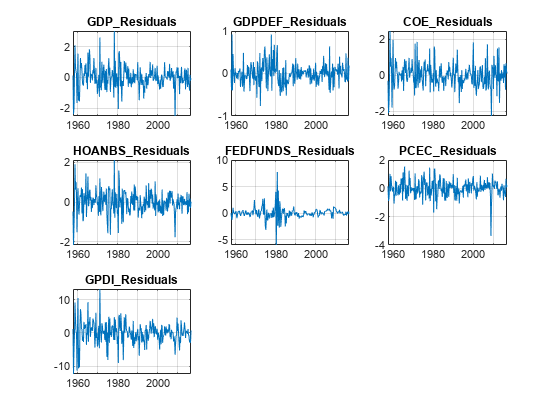

Plot the residuals.

varnames = Tbl2.Properties.VariableNames; resnames = varnames(contains(Tbl2.Properties.VariableNames,"_Residuals")); figure tiledlayout(3,3) for j = 1:7 nexttile plot(Tbl2.Time,Tbl2{:,resnames(j)}) title(resnames(j),Interpreter="none") grid on end

Consider the model and data in Fit VEC(1) Model to Matrix of Response Data.

Load the Data_USEconVECModel data set and preprocess the data.

load Data_USEconVECModel

FRED.GDP = 100*log(FRED.GDP);

FRED.GDPDEF = 100*log(FRED.GDPDEF);

FRED.COE = 100*log(FRED.COE);

FRED.HOANBS = 100*log(FRED.HOANBS);

FRED.PCEC = 100*log(FRED.PCEC);

FRED.GPDI = 100*log(FRED.GPDI);The Data_Recessions data set contains the beginning and ending serial dates of recessions. Load this data set. Convert the matrix of date serial numbers to a datetime array.

load Data_Recessions dtrec = datetime(Recessions,'ConvertFrom','datenum');

Create a dummy variable that identifies periods in which the U.S. was in a recession or worse. Specifically, the variable should be 1 if FRED.Time occurs during a recession, and 0 otherwise.

isin = @(x)(any(dtrec(:,1) <= x & x <= dtrec(:,2))); isrecession = double(arrayfun(isin,FRED.Time));

Create a VEC(1) model using the shorthand syntax. Assume that the appropriate cointegration rank is 4. You do not have to specify the presence of a regression component when creating the model. Specify the variable names.

Mdl = vecm(7,4,1); Mdl.SeriesNames = FRED.Properties.VariableNames;

Estimate the model using the entire sample. Specify the predictor identifying whether the observation was measured during a recession. Return the standard errors.

[EstMdl,EstSE] = estimate(Mdl,FRED.Variables,'X',isrecession);Display the regression coefficient for each equation and the corresponding standard errors.

EstMdl.Beta

ans = 7×1

-1.1975

-0.0187

-0.7530

-0.7094

-0.5932

-0.6835

-4.4839

EstSE.Beta

ans = 7×1

0.1547

0.0581

0.1507

0.1278

0.2471

0.1311

0.7150

EstMdl.Beta and EstSE.Beta are 7-by-1 vectors. Rows correspond to response variables in EstMdl.SeriesNames and columns correspond to predictors.

To check whether the effects of recessions are significant, obtain summary statistics from summarize, and then display the results for Beta.

results = summarize(EstMdl);

isbeta = contains(results.Table.Properties.RowNames,'Beta');

betaresults = results.Table(isbeta,:)betaresults=7×4 table

Value StandardError TStatistic PValue

_________ _____________ __________ __________

Beta(1,1) -1.1975 0.15469 -7.7411 9.8569e-15

Beta(2,1) -0.018738 0.05806 -0.32273 0.7469

Beta(3,1) -0.75305 0.15071 -4.9966 5.8341e-07

Beta(4,1) -0.70936 0.12776 -5.5521 2.8221e-08

Beta(5,1) -0.5932 0.24712 -2.4004 0.016377

Beta(6,1) -0.68353 0.13107 -5.2151 1.837e-07

Beta(7,1) -4.4839 0.715 -6.2712 3.5822e-10

whichsig = EstMdl.SeriesNames(betaresults.PValue < 0.05)

whichsig = 1×6 string

"GDP" "COE" "HOANBS" "FEDFUNDS" "PCEC" "GPDI"

All series except GDPDEF appear to have a significant recessions effect.

Input Arguments

VEC model containing unknown parameter values, specified as a vecm model object returned by vecm.

NaN-valued elements in properties indicate unknown, estimable parameters. Specified elements indicate equality constraints on parameters in model estimation. The innovations covariance matrix Mdl.Covariance cannot contain a mix of NaN values and real numbers; you must fully specify the covariance or it must be completely unknown (NaN(Mdl.NumSeries)).

Observed multivariate response series to which estimate fits the

model, specified as a numobs-by-numseries numeric

matrix.

numobs is the sample size. numseries is the

number of response variables (Mdl.NumSeries).

Rows correspond to observations, and the last row contains the latest observation.

Columns correspond to individual response variables.

Y represents the continuation of the presample response series in

Y0.

Data Types: double

Since R2022b

Time series data, to which estimate fits the model, specified

as a table or timetable with numvars variables and

numobs rows.

Each variable is a numeric vector representing a single path of

numobs observations. You can optionally specify

numseries response variables to fit to the model by using the

ResponseVariables name-value argument, and you can specify

numpreds predictor variables for the exogenous regression

component by using the PredictorVariables name-value argument.

Each row is an observation, and measurements in each row occur simultaneously.

If Tbl1 is a timetable, it must represent a sample with a regular

datetime time step (see isregular), and the datetime vector

Tbl1.Time must be ascending or descending.

If Tbl1 is a table, the last row contains the latest

observation.

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: estimate(Mdl,Y,Model="H1*",X=Exo) fits the

VEC(p – 1) model Mdl to the matrix of

response data Y, and specifies the H1* Johansen form of the

deterministic terms and the matrix of exogenous predictor data

Exo.

Since R2022b

Variables to select from Tbl1 to treat as response variables

yt, specified as one of the following

data types:

String vector or cell vector of character vectors containing

numseriesvariable names inTbl1.Properties.VariableNamesA length

numseriesvector of unique indices (integers) of variables to select fromTbl1.Properties.VariableNamesA length

numvarslogical vector, whereResponseVariables(selects variablej) = truejTbl1.Properties.VariableNames, andsum(ResponseVariables)isnumseries

The selected variables must be numeric vectors and cannot contain missing values

(NaN).

If the number of variables in Tbl1 matches

Mdl.NumSeries, the default specifies all variables in

Tbl1. If the number of variables in Tbl1

exceeds Mdl.NumSeries, the default matches variables in

Tbl1 to names in Mdl.SeriesNames.

Example: ResponseVariables=["GDP" "CPI"]

Example: ResponseVariables=[true false true false] or

ResponseVariable=[1 3] selects the first and third table

variables as the response variables.

Data Types: double | logical | char | cell | string

Presample response observations to initialize the model for estimation, specified as a

numpreobs-by-numseries numeric matrix.

numpreobs is the number of presample observations. Use

Y0 only when you supply a matrix of response data

Y.

Rows correspond to presample observations, and the last row contains the latest

observation. Y0 must have at least Mdl.P rows. If

you supply more rows than necessary, estimate uses the latest

Mdl.P observations only.

Columns must correspond to the numseries response variables in

Y.

By default, estimate uses Y(1:Mdl.P,:) as

presample observations, and then fits the model to Y((Mdl.P +

1):end,:). This action reduces the effective sample size.

Data Types: double

Since R2022b

Presample data to initialize the model for estimation, specified as a table or

timetable, the same type as Tbl1, with

numprevars variables and numpreobs rows. Use

Presample only when you supply a table or timetable of data

Tbl1.

Each variable is a single path of numpreobs observations

representing the presample of the corresponding variable in

Tbl1.

Each row is a presample observation, and measurements in each row occur

simultaneously. numpreobs must be at least Mdl.P.

If you supply more rows than necessary, estimate uses the latest

Mdl.P observations only.

If Presample is a timetable, all the following conditions must be true:

Presamplemust represent a sample with a regular datetime time step (seeisregular).The inputs

Tbl1andPresamplemust be consistent in time such thatPresampleimmediately precedesTbl1with respect to the sampling frequency and order.The datetime vector of sample timestamps

Presample.Timemust be ascending or descending.

If Presample is a table, the last row contains the latest

presample observation.

By default, estimate uses the first or earliest

Mdl.P observations in Tbl1 as a presample,

and then it fits the model to the remaining numobs – Mdl.P

observations. This action reduces the effective sample size.

Since R2022b

Variables to select from Presample to use for presample data,

specified as one of the following data types:

String vector or cell vector of character vectors containing

numseriesvariable names inPresample.Properties.VariableNamesA length

numseriesvector of unique indices (integers) of variables to select fromPresample.Properties.VariableNamesA length

numprevarslogical vector, wherePresampleResponseVariables(selects variablej) = truejPresample.Properties.VariableNames, andsum(PresampleResponseVariables)isnumseries

The selected variables must be numeric vectors and cannot contain missing values

(NaN).

PresampleResponseNames does not need to contain the same names as

in Tbl1; estimate uses the data in selected

variable PresampleResponseVariables( as

a presample for

j)ResponseVariables(.j)

The default specifies the same response variables as those selected from

Tbl1, see ResponseVariables.

Example: PresampleResponseVariables=["GDP" "CPI"]

Example: PresampleResponseVariables=[true false true false] or

PresampleResponseVariable=[1 3] selects the first and third table

variables for presample data.

Data Types: double | logical | char | cell | string

Predictor data for the regression component in the model, specified as a numeric

matrix containing numpreds columns. Use X only

when you supply a matrix of response data Y.

numpreds is the number of predictor variables.

Rows correspond to observations, and the last row contains the latest observation.

estimate does not use the regression component in the

presample period. X must have at least as many observations as are

used after the presample period:

If you specify

Y0,Xmust have at leastnumobsrows (seeY).Otherwise,

Xmust have at leastnumobs–Mdl.Pobservations to account for the presample removal.

In either case, if you supply more rows than necessary,

estimate uses the latest observations only.

Columns correspond to individual predictor variables. All predictor variables are present in the regression component of each response equation.

By default, estimate excludes the regression component,

regardless of its presence in Mdl.

Data Types: double

Since R2022b

Variables to select from Tbl1 to treat as exogenous predictor variables

xt, specified as one of the following data types:

String vector or cell vector of character vectors containing

numpredsvariable names inTbl1.Properties.VariableNamesA length

numpredsvector of unique indices (integers) of variables to select fromTbl1.Properties.VariableNamesA length

numvarslogical vector, wherePredictorVariables(selects variablej) = truejTbl1.Properties.VariableNames, andsum(PredictorVariables)isnumpreds

The selected variables must be numeric vectors and cannot contain missing values

(NaN).

By default, estimate excludes the regression component, regardless

of its presence in Mdl.

Example: PredictorVariables=["M1SL" "TB3MS" "UNRATE"]

Example: PredictorVariables=[true false true false] or

PredictorVariable=[1 3] selects the first and third table variables to

supply the predictor data.

Data Types: double | logical | char | cell | string

Johansen form of the VEC(p – 1) model deterministic terms [2], specified as a value in this table (for variable definitions, see Vector Error-Correction Model).

| Value | Error-Correction Term | Description |

|---|---|---|

"H2" | AB´yt − 1 | No intercepts or trends are present in the cointegrating relations, and no deterministic trends are present in the levels of the data. Specify this model only when all response series have a mean of zero. |

"H1*" | A(B´yt−1+c0) | Intercepts are present in the cointegrating relations, and no deterministic trends are present in the levels of the data. |

"H1" | A(B´yt−1+c0)+c1 | Intercepts are present in the cointegrating relations, and deterministic linear trends are present in the levels of the data. |

"H*" | A(B´yt−1+c0+d0t)+c1 | Intercepts and linear trends are present in the cointegrating relations, and deterministic linear trends are present in the levels of the data. |

"H" | A(B´yt−1+c0+d0t)+c1+d1t | Intercepts and linear trends are present in the cointegrating relations, and deterministic quadratic trends are present in the levels of the data. If quadratic trends are not present in the data, this model can produce good in-sample fits but poor out-of-sample forecasts. |

During estimation, if the overall model constant, overall linear trend, cointegrating constant, or cointegrating linear trend parameters are not in the model, then estimate constrains them to zero. If you specify a different equality constraint, that is, if the properties corresponding to those deterministic terms being constrained to zero have a value other than a vector of NaN values or zeros, then estimate issues an error. To enforce supported equality constraints, choose the Johansen model containing the deterministic term that you want to constrain.

Example: Model="H1*"

Data Types: string | char

Estimation information display type, specified as a value in this table.

| Value | Description |

|---|---|

"off" | estimate does not display estimation

information at the command line. |

"table" | estimate displays a table of estimation

information. Rows correspond to parameters, and columns correspond to

estimates, standard errors, t statistics, and

p values. |

"full" | In addition to a table of summary statistics,

estimate displays the estimated innovations

covariance and correlation matrices, loglikelihood value, Akaike

Information Criterion (AIC), Bayesian Information Criterion (BIC), and

other estimation information. |

Example: Display="full"

Data Types: string | char

Maximum number of solver iterations allowed, specified as a positive numeric scalar.

estimate dispatches

MaxIterations to mvregress.

Example: MaxIterations=2000

Data Types: double

Note

NaNvalues inY,Y0, andXindicate missing values.estimateremoves missing values from the data by list-wise deletion.For the presample,

estimateremoves any row containing at least oneNaN.For the estimation sample,

estimateremoves any row of the concatenated data matrix[Y X]containing at least oneNaN.

This type of data reduction reduces the effective sample size.

estimateissues an error when any table or timetable input contains missing values.

Output Arguments

Estimated VEC(p – 1) model, returned as a vecm model object. EstMdl is a fully specified vecm model.

estimate uses mvregress to implement multivariate normal, maximum likelihood estimation. For more details, see Estimation of Multivariate Regression Models.

Estimated, asymptotic standard errors of the estimated parameters, returned as a structure array containing the fields in this table.

| Field | Description |

|---|---|

Constant | Standard errors of the overall model constants (c) corresponding to the estimates in EstMdl.Constant, an Mdl.NumSeries-by-1 numeric vector |

Adjustment | Standard errors of the adjustment speeds (A) corresponding to the estimates in EstMdl.Adjustment, an Mdl.NumSeries-by-Mdl.Rank numeric vector |

Impact | Standard errors of the impact coefficient (Π) corresponding to the estimates in EstMdl.Impact, an Mdl.NumSeries-by-Mdl.NumSeries numeric vector |

ShortRun | Standard errors of the short-run coefficients (Φ) corresponding to estimates in EstMdl.ShortRun, a cell vector with elements corresponding to EstMdl.ShortRun |

Beta | Standard errors of regression coefficients (β) corresponding to the estimates in EstMdl.Beta, an Mdl.NumSeries-by-numpreds numeric matrix |

Trend | Standard errors of the overall linear time trends (d) corresponding to the estimates in EstMdl.Trend, an Mdl.NumSeries-by-1 numeric vector |

If estimate applies equality constraints during estimation by fixing any parameters to a value, then corresponding standard errors of those parameters are 0.

estimate extracts all standard errors from the inverse of the expected Fisher information matrix returned by mvregress (see Standard Errors).

Optimized loglikelihood objective function value, returned as a numeric scalar.

Multivariate residuals from the fitted model EstMdl, returned as

a numeric matrix containing numseries columns.

estimate returns E only when you supply a

matrix of response data Y.

If you specify

Y0, thenEhasnumobsrows (seeY).Otherwise,

Ehasnumobs–Mdl.Prows to account for the presample removal.

Since R2022b

Multivariate residuals and estimation data, returned as a table or timetable, the same

data type as Tbl1. estimate returns

Tbl2 only when you supply the input

Tbl1.

Tbl2 contains the residuals E from the model

fit to the selected variables in Tbl1, and it contains all

variables in Tbl1. estimate names the

residuals corresponding to variable

ResponseJTbl1

ResponseJ_ResidualsTbl1 is

GDP, Tbl2 contains a variable for the

residuals in the response equation of GDP with the name

GDP_Residuals.

If you specify presample response data, Tbl2 and

Tbl1 have the same number of rows, and their rows correspond.

Otherwise, because estimate removes initial observations from

Tbl1 for the required presample by default,

Tbl2 has numobs – Mdl.P rows to account for

that removal.

If Tbl1 is a timetable, Tbl1 and

Tbl2 have the same row order, either ascending or

descending.

More About

A vector error-correction (VEC) model is a

multivariate, stochastic time series model consisting of a system of m =

numseries equations of m distinct, differenced

response variables. Equations in the system can include an error-correction

term, which is a linear function of the responses in levels used to

stabilize the system. The cointegrating rank

r is the number of cointegrating relations that

exist in the system.

Each response equation can include an autoregressive polynomial composed of first differences of the response series (short-run polynomial of degree p – 1), a constant, a time trend, exogenous predictor variables, and a constant and time trend in the error-correction term.

A VEC(p – 1) model in difference-equation notation and in reduced form can be expressed in two ways:

This equation is the component form of a VEC model, where the cointegration adjustment speeds and cointegration matrix are explicit, whereas the impact matrix is implied.

The cointegrating relations are B'yt – 1 + c0 + d0t and the error-correction term is A(B'yt – 1 + c0 + d0t).

This equation is the impact form of a VEC model, where the impact matrix is explicit, whereas the cointegration adjustment speeds and cointegration matrix are implied.

In the equations:

yt is an m-by-1 vector of values corresponding to m response variables at time t, where t = 1,...,T.

Δyt = yt – yt – 1. The structural coefficient is the identity matrix.

r is the number of cointegrating relations and, in general, 0 < r < m.

A is an m-by-r matrix of adjustment speeds.

B is an m-by-r cointegration matrix.

Π is an m-by-m impact matrix with a rank of r.

c0 is an r-by-1 vector of constants (intercepts) in the cointegrating relations.

d0 is an r-by-1 vector of linear time trends in the cointegrating relations.

c1 is an m-by-1 vector of constants (deterministic linear trends in yt).

d1 is an m-by-1 vector of linear time-trend values (deterministic quadratic trends in yt).

c = Ac0 + c1 and is the overall constant.

d = Ad0 + d1 and is the overall time-trend coefficient.

Φj is an m-by-m matrix of short-run coefficients, where j = 1,...,p – 1 and Φp – 1 is not a matrix containing only zeros.

xt is a k-by-1 vector of values corresponding to k exogenous predictor variables.

β is an m-by-k matrix of regression coefficients.

εt is an m-by-1 vector of random Gaussian innovations, each with a mean of 0 and collectively an m-by-m covariance matrix Σ. For t ≠ s, εt and εs are independent.

Condensed and in lag operator notation, the system is

where , I is the m-by-m identity matrix, and Lyt = yt – 1.

If m = r, then the VEC model is a stable VAR(p) model in the levels of the responses. If r = 0, then the error-correction term is a matrix of zeros, and the VEC(p – 1) model is a stable VAR(p – 1) model in the first differences of the responses.

The Johansen forms of a VEC Model differ with respect to the presence of deterministic terms. As detailed in [2], the estimation procedure differs among the forms. Consequently, allowable equality constraints on the deterministic terms during estimation differ among forms. For more details, see The Role of Deterministic Terms.

This table describes the five Johansen forms and supported equality constraints.

| Form | Error-Correction Term | Deterministic Coefficients | Equality Constraints |

|---|---|---|---|

| H2 | AB´yt − 1 | c = 0 (Constant). d = 0 (Trend). c0 = 0 (CointegrationConstant). d0 = 0 (CointegrationTrend). | You can fully specify B. All deterministic coefficients are zero. |

| H1* | A(B´yt−1+c0) | c = Ac0. d = 0. d0 = 0. | If you fully specify either B or c0, then you must fully specify the other. MATLAB® derives the value of c from c0 and A. All deterministic trends are zero. |

| H1 | A(B´yt−1 + c0) + c1 | c = Ac0 + c1. d = 0. d0 = 0. | You can fully specify B. You can specify a mixture of MATLAB derives the value of c0 from c and A. All deterministic trends are zero. |

| H* | A(B´yt−1 + c0 + d0t) + c1 | c = Ac0 + c1. d = Ad0. | If you fully specify either B or d0, then you must fully specify the other. You can specify a mixture of MATLAB derives the value of c0 from c and A. MATLAB derives the value of d from A and d0. |

| H | A(B´yt−1+c0+d0t)+c1+d1t | c = Ac0 + c1. d = A.d0 + d1. | You can fully specify B. You can specify a mixture of MATLAB derives the values of c0 and d0 from c, d, and A. |

Algorithms

If 1 ≤

Mdl.Rank≤Mdl.NumSeries–1, as with most VEC models, thenestimateperforms parameter estimation in two steps.estimateestimates the parameters of the cointegrating relations, including any restricted intercepts and time trends, by the Johansen method [2].The form of the cointegrating relations corresponds to one of the five parametric forms considered by Johansen in [2] (see

'Model'). For more details, seejcitestandjcontest.The adjustment speed parameter (A) and the cointegration matrix (B) in the VEC(p – 1) model cannot be uniquely identified. However, the product Π = A*Bʹ is identifiable. In this estimation step, B = V1:r, where V1:r is the matrix composed of all rows and the first r columns of the eigenvector matrix V. V is normalized so that Vʹ*S11*V = I. For more details, see [2].

estimateconstructs the error-correction terms from the estimated cointegrating relations. Then,estimateestimates the remaining terms in the VEC model by constructing a vector autoregression (VAR) model in first differences and including the error-correction terms as predictors. For models without cointegrating relations (Mdl.Rank= 0) or with a cointegrating matrix of full rank (Mdl.Rank=Mdl.Numseries),estimateperforms this VAR estimation step only.

You can remove stationary series, which are associated with standard unit vectors in the space of cointegrating relations, from cointegration analysis. To pretest individual series for stationarity, use

adftest,pptest,kpsstest, andlmctest. As an alternative, you can test for standard unit vectors in the context of the full model by usingjcontest.If

1≤Mdl.Rank≤Mdl.NumSeries–1, the asymptotic error covariances of the parameters in the cointegrating relations (which include B, c0, and d0 corresponding to theCointegration,CointegrationConstant, andCointegrationTrendproperties, respectively) are generally non-Gaussian. Therefore,estimatedoes not estimate or return corresponding standard errors.In contrast, the error covariances of the composite impact matrix, which is defined as the product A*Bʹ, are asymptotically Gaussian. Therefore,

estimateestimates and returns its standard errors. Similar caveats hold for the standard errors of the overall constant and linear trend (A*c0 and A*d0corresponding to theConstantandTrendproperties, respectively) of the H1* and H* Johansen forms.

References

[1] Hamilton, James D. Time Series Analysis. Princeton, NJ: Princeton University Press, 1994.

[2] Johansen, S. Likelihood-Based Inference in Cointegrated Vector Autoregressive Models. Oxford: Oxford University Press, 1995.

[3] Juselius, K. The Cointegrated VAR Model. Oxford: Oxford University Press, 2006.

[4] Lütkepohl, H. New Introduction to Multiple Time Series Analysis. Berlin: Springer, 2005.

Version History

Introduced in R2017bIn addition to accepting input data in numeric arrays,

estimate accepts input data in tables and timetables. estimate chooses default series on which to operate, but you can use the following name-value arguments to select variables.

ResponseVariablesspecifies the response series names in the input data to which the model is fit.PredictorVariablesspecifies the predictor series names in the input data for a model regression component.Presamplespecifies the input table or timetable of presample response data.PresampleResponseVariablesspecifies the response series names fromPresample.

If you specify a positive definite innovations covariance matrix for the

Covariance property, estimate treats your

specification as an equality constraint in model estimation.

See Also

Objects

Functions

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Select a Web Site

Choose a web site to get translated content where available and see local events and offers. Based on your location, we recommend that you select: .

You can also select a web site from the following list

How to Get Best Site Performance

Select the China site (in Chinese or English) for best site performance. Other MathWorks country sites are not optimized for visits from your location.

Americas

- América Latina (Español)

- Canada (English)

- United States (English)

Europe

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)