Logistic

Create Logistic model object for lifetime probability of

default

Description

Create and analyze a Logistic model object to calculate

the lifetime probability (PD) of default using this workflow:

Use

fitLifetimePDModelto create aLogisticmodel object.Use

predictto predict the conditional PD andpredictLifetimeto predict the lifetime PD.Use

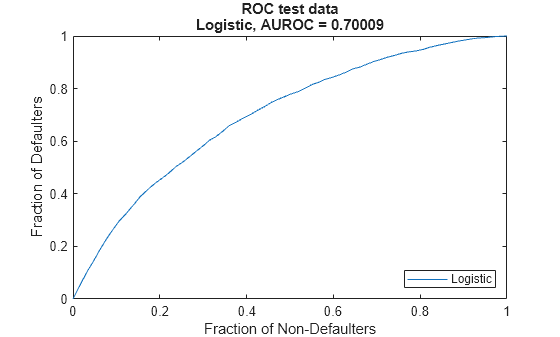

modelDiscriminationto return AUROC and ROC data. You can plot the results usingmodelDiscriminationPlot.Use

modelCalibrationto return the RMSE of the observed and predicted PD data. You can plot the results usingmodelCalibrationPlot.

Creation

Syntax

Description

LogisticPDModel = fitLifetimePDModel(data,ModelType)Logistic PD model object.

If you do not specify variable information for

IDVar, AgeVar,

LoanVars, MacroVars, and

ResponseVar, then:

IDVaris set to the first column in thedatainput.LoanVarsis set to include all columns from the second to the second-to-last columns of thedatainput.ResponseVaris set to the last column in thedatainput.

LogisticPDModel = fitLifetimePDModel(___,Name,Value)LogisticPDModel =

fitLifetimePDModel(data(TrainDataInd,:),"Logistic",ModelID="Logistic_A",Description="Logisitic_model",AgeVar="YOB",IDVar="ID",LoanVars="ScoreGroup",MacroVars={'GDP','Market'},ResponseVar="Default",WeightsVar="Weights")

creates a LogisticPDModel object using a

Logistic model type.

Input Arguments

Name-Value Arguments

Properties

Object Functions

predict | Compute conditional PD |

predictLifetime | Compute cumulative lifetime PD, marginal PD, and survival probability |

modelDiscrimination | Compute AUROC and ROC data |

modelCalibration | Compute RMSE of predicted and observed PDs on grouped data |

modelDiscriminationPlot | Plot ROC curve |

modelCalibrationPlot | Plot observed default rates compared to predicted PDs on grouped data |

Examples

More About

References

[1] Baesens, Bart, Daniel Roesch, and Harald Scheule. Credit Risk Analytics: Measurement Techniques, Applications, and Examples in SAS. Wiley, 2016.

[2] Bellini, Tiziano. IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SAS. San Diego, CA: Elsevier, 2019.

[3] Breeden, Joseph. Living with CECL: The Modeling Dictionary. Santa Fe, NM: Prescient Models LLC, 2018.

[4] Roesch, Daniel and Harald Scheule. Deep Credit Risk: Machine Learning with Python. Independently published, 2020.

Version History

Introduced in R2020bSee Also

Functions

Topics

- Basic Lifetime PD Model Validation

- Compare Logistic Model for Lifetime PD to Champion Model

- Compare Lifetime PD Models Using Cross-Validation

- Expected Credit Loss Computation

- Compare Model Discrimination and Model Calibration to Validate of Probability of Default

- Compare Probability of Default Using Through-the-Cycle and Point-in-Time Models

- Create Weighted Lifetime PD Model

- Overview of Lifetime Probability of Default Models