Price Swaptions with Interest-Rate Models Using Simulation

Introduction

This example shows how to price European swaptions using interest-rate models in Financial Instruments Toolbox™. Specifically, a Hull-White one factor model, a Linear Gaussian two-factor model, and a LIBOR Market Model are calibrated to market data and then used to generate interest-rate paths using Monte Carlo simulation.

The following sections set up the data that is then used with examples for Simulate Interest-Rate Paths Using the Hull-White One-Factor Model, Simulate Interest-Rate Paths Using the Linear Gaussian Two-Factor Model, and Simulate Interest-Rate Paths Using the LIBOR Market Model:

Construct a Zero Curve

This example shows how to use ZeroRates for a zero curve that is hard-coded. You can also create a zero curve by bootstrapping the zero curve from market data (for example, deposits, futures/forwards, and swaps)

The hard-coded data for the zero curve is defined as:

Settle = datetime(2008,7,21); % Zero Curve CurveDates = daysadd(Settle,360*([1 3 5 7 10 20]),1); ZeroRates = [1.9 2.6 3.1 3.5 4 4.3]'/100; plot(CurveDates,ZeroRates) datetick title(['Zero Curve for ' datestr(Settle)]);

Construct an IRDataCurve object.

irdc = IRDataCurve('Zero',Settle,CurveDates,ZeroRates);Create the RateSpec using intenvset.

RateSpec = intenvset('Rates',ZeroRates,'EndDates',CurveDates,'StartDate',Settle)

RateSpec = struct with fields:

FinObj: 'RateSpec'

Compounding: 2

Disc: [6×1 double]

Rates: [6×1 double]

EndTimes: [6×1 double]

StartTimes: [6×1 double]

EndDates: [6×1 double]

StartDates: 733610

ValuationDate: 733610

Basis: 0

EndMonthRule: 1

Define Swaption Parameters

While Monte Carlo simulation is typically used to value more sophisticated derivatives (for example, Bermudan swaptions), in this example, the price of a European swaption is computed with an exercise date of five years and an underlying swap of five years.

InstrumentExerciseDate = datenum('21-Jul-2013'); InstrumentMaturity = datenum('21-Jul-2018'); InstrumentStrike = .045;

Compute the Black Model and the Swaption Volatility Matrix

Black's model is often used to price and quote European exercise interest-rate options, that is, caps, floors and swaptions. In the case of swaptions, Black's model is used to imply a volatility given the current observed market price. The following matrix shows the Black implied volatility for a range of swaption exercise dates (columns) and underlying swap maturities (rows).

SwaptionBlackVol = [22 21 19 17 15 13 12

21 19 17 16 15 13 11

20 18 16 15 14 12 11

19 17 15 14 13 12 10

18 16 14 13 12 11 10

15 14 13 12 12 11 10

13 13 12 11 11 10 9]/100;

ExerciseDates = [1:5 7 10];

Tenors = [1:5 7 10];

EurExDatesFull = repmat(daysadd(Settle,ExerciseDates*360,1)',...

length(Tenors),1);

EurMatFull = reshape(daysadd(EurExDatesFull,...

repmat(360*Tenors,1,length(ExerciseDates)),1),size(EurExDatesFull));Select Calibration Instruments

Selecting the instruments to calibrate the model to is one of the tasks in calibration. For Bermudan swaptions, it is typical to calibrate to European swaptions that are co-terminal with the Bermudan swaption to be priced. In this case, all swaptions having an underlying tenor that matures before the maturity of the swaption to be priced (21-Jul-2018) are used in the calibration.

% Find the swaptions that expire on or before the maturity date of the % sample swaption relidx = find(EurMatFull <= InstrumentMaturity);

Compute Swaption Prices Using Black's Model

This example shows how to compute swaption prices using Black's Model. The swaption prices are then used to compare the model’s predicted values that are obtained from the calibration process.

To compute the swaption prices using Black's model:

SwaptionBlackPrices = zeros(size(SwaptionBlackVol)); SwaptionStrike = zeros(size(SwaptionBlackVol)); for iSwaption=1:length(ExerciseDates) for iTenor=1:length(Tenors) [~,SwaptionStrike(iTenor,iSwaption)] = swapbyzero(RateSpec,[NaN 0], Settle, EurMatFull(iTenor,iSwaption),... 'StartDate',EurExDatesFull(iTenor,iSwaption),'LegReset',[1 1]); SwaptionBlackPrices(iTenor,iSwaption) = swaptionbyblk(RateSpec, 'call', SwaptionStrike(iTenor,iSwaption),Settle, ... EurExDatesFull(iTenor,iSwaption), EurMatFull(iTenor,iSwaption), SwaptionBlackVol(iTenor,iSwaption)); end end

Define Simulation Parameters

This example shows how to use the

simTermStructs method with

HullWhite1F, LinearGaussian2F, and

LiborMarketModel objects.

To demonstrate using the simTermStructs method with

HullWhite1F, LinearGaussian2F, and

LiborMarketModel objects, use the following

simulation

parameters:

nPeriods = 5; DeltaTime = 1; nTrials = 1000; Tenor = (1:10)'; SimDates = daysadd(Settle,360*DeltaTime*(0:nPeriods),1) SimTimes = diff(yearfrac(SimDates(1),SimDates)) % For 1 year periods and an evenly spaced tenor, the exercise row will be % the 5th row and the swaption maturity will be the 5th column exRow = 5; endCol = 5;

SimDates =

733610

733975

734340

734705

735071

735436

SimTimes =

1.0000

1.0000

1.0000

1.0027

1.0000Simulate Interest-Rate Paths Using the Hull-White One-Factor Model

This example shows how to simulate interest-rate paths using

the Hull-White one-factor model. Before beginning this example that uses a

HullWhite1F model, make sure that you have set up the

data as described in:

The Hull-White one-factor model describes the evolution of the short rate and is specified using the zero curve, alpha, and sigma parameters for the equation

where:

dr is the change in the short-term interest rate over a small interval, dt.

r is the short-term interest rate.

Θ(t) is a function of time determining the average direction in which r moves, chosen such that movements in r are consistent with today's zero coupon yield curve.

α is the mean reversion rate.

dt is a small change in time.

σ is the annual standard deviation of the short rate.

W is the Brownian motion.

The Hull-White model is calibrated using the function

swaptionbyhw, which constructs a trinomial tree to price

the swaptions. Calibration consists of minimizing the difference between the

observed market prices (computed above using the Black's implied swaption

volatility matrix, see Compute the Black Model and the Swaption Volatility Matrix) and the model’s

predicted prices.

In this example, the Optimization Toolbox™ function lsqnonlin is used to find the

parameter set that minimizes the difference between the observed and predicted

values. However, other approaches (for example, simulated annealing) may be

appropriate. Starting parameters and constraints for α and

σ are set in the variables x0,

lb, and ub; these could also be varied

depending upon the particular calibration approach.

Calibrate the set of parameters that minimize the difference between the

observed and predicted values using swaptionbyhw and

lsqnonlin.

TimeSpec = hwtimespec(Settle,daysadd(Settle,360*(1:11),1), 2); HW1Fobjfun = @(x) SwaptionBlackPrices(relidx) - ... swaptionbyhw(hwtree(hwvolspec(Settle,'11-Aug-2015',x(2),'11-Aug-2015',x(1)), RateSpec, TimeSpec), 'call', SwaptionStrike(relidx),... EurExDatesFull(relidx), 0, EurExDatesFull(relidx), EurMatFull(relidx)); options = optimset('disp','iter','MaxFunEvals',1000,'TolFun',1e-5); % Find the parameters that minimize the difference between the observed and % predicted prices x0 = [.1 .01]; lb = [0 0]; ub = [1 1]; HW1Fparams = lsqnonlin(HW1Fobjfun,x0,lb,ub,options); HW_alpha = HW1Fparams(1) HW_sigma = HW1Fparams(2)

Norm of First-order

Iteration Func-count f(x) step optimality

0 3 0.953772 20.5

1 6 0.142828 0.0169199 1.53

2 9 0.123022 0.0146705 2.31

3 12 0.122222 0.0154098 0.482

4 15 0.122217 0.00131297 0.00409

Local minimum possible.

lsqnonlin stopped because the final change in the sum of squares relative to

its initial value is less than the selected value of the function tolerance.

HW_alpha =

0.0967

HW_sigma =

0.0088Construct the HullWhite1F model using the HullWhite1F

constructor.

HW1F = HullWhite1F(RateSpec,HW_alpha,HW_sigma)

HW1F =

HullWhite1F with properties:

ZeroCurve: [1x1 IRDataCurve]

Alpha: @(t,V)inAlpha

Sigma: @(t,V)inSigmaUse Monte Carlo simulation to generate the interest-rate paths with

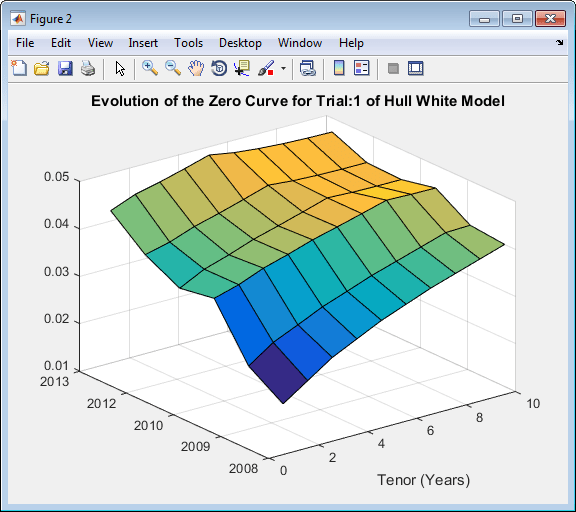

HullWhite1F.simTermStructs.

HW1FSimPaths = HW1F.simTermStructs(nPeriods,'NTRIALS',nTrials,... 'DeltaTime',DeltaTime,'Tenor',Tenor,'antithetic',true); trialIdx = 1; figure surf(Tenor,SimDates,HW1FSimPaths(:,:,trialIdx)) datetick y keepticks keeplimits title(['Evolution of the Zero Curve for Trial:' num2str(trialIdx) ' of Hull White Model']) xlabel('Tenor (Years)')

Price the European swaption.

DF = exp(bsxfun(@times,-HW1FSimPaths,repmat(Tenor',[nPeriods+1 1]))); SwapRate = (1 - DF(exRow,endCol,:))./sum(bsxfun(@times,1,DF(exRow,1:endCol,:))); PayoffValue = 100*max(SwapRate-InstrumentStrike,0).*sum(bsxfun(@times,1,DF(exRow,1:endCol,:))); RealizedDF = prod(exp(bsxfun(@times,-HW1FSimPaths(1:exRow,1,:),SimTimes(1:exRow))),1); HW1F_SwaptionPrice = mean(RealizedDF.*PayoffValue)

HW1F_SwaptionPrice =

2.1839 Simulate Interest-Rate Paths Using the Linear Gaussian Two-Factor Model

This example shows how to simulate interest-rate paths using

the Linear Gaussian two-factor model. Before beginning this example that uses a

LinearGaussian2F model, make sure that you have set up

the data as described in:

The Linear Gaussian two-factor model (called the G2++ by Brigo and Mercurio, see Interest-Rate Modeling Using Monte Carlo Simulation) is also a short rate model, but involves two factors. Specifically:

where is a two-dimensional Brownian motion with correlation ρ, and ϕ is a function chosen to match the initial zero curve.

The function swaptionbylg2f is used to compute analytic

values of the swaption price for model parameters, and therefore can be used to

calibrate the model. Calibration consists of minimizing the difference between

the observed market prices (computed above using the Black's implied swaption

volatility matrix, see Compute the Black Model and the Swaption Volatility Matrix) and the model’s

predicted prices.

In this example, the approach is similar to Simulate Interest-Rate Paths Using the Hull-White One-Factor Model

and the Optimization Toolbox function lsqnonlin is used to minimize the

difference between the observed swaption prices and the predicted swaption

prices. However, other approaches (for example, simulated annealing) may also be

appropriate. Starting parameters and constraints for a,

b, η, ρ, and

σ are set in the variables x0,

lb, and ub; these could also be varied

depending upon the particular calibration approach.

Calibrate the set of parameters that minimize the difference between the

observed and predicted values using swaptionbylg2f and

lsqnonlin.

G2PPobjfun = @(x) SwaptionBlackPrices(relidx) - swaptionbylg2f(irdc,x(1),x(2),x(3),x(4),x(5),SwaptionStrike(relidx),... EurExDatesFull(relidx),EurMatFull(relidx),'Reset',1); options = optimset('disp','iter','MaxFunEvals',1000,'TolFun',1e-5); x0 = [.2 .1 .02 .01 -.5]; lb = [0 0 0 0 -1]; ub = [1 1 1 1 1]; LG2Fparams = lsqnonlin(G2PPobjfun,x0,lb,ub,options)

Norm of First-order

Iteration Func-count f(x) step optimality

0 6 12.3547 67.6

1 12 1.37984 0.0979743 8.59

2 18 1.37984 0.112847 8.59

3 24 0.445202 0.0282118 1.31

4 30 0.236746 0.0564236 3.02

5 36 0.134678 0.0843366 7.78

6 42 0.0398816 0.015084 6.34

7 48 0.0287731 0.038967 0.732

8 54 0.0273025 0.112847 0.881

9 60 0.0241689 0.213033 1.06

10 66 0.0241689 0.125602 1.06

11 72 0.0239103 0.0314005 9.78

12 78 0.0234246 0.0286685 1.21

13 84 0.0234246 0.0491135 1.21

14 90 0.023304 0.0122784 1.67

15 96 0.0231931 0.0245568 5.92

16 102 0.0230898 0.00785421 0.434

17 108 0.0230898 0.0245568 0.434

18 114 0.023083 0.00613919 0.255

Local minimum possible.

lsqnonlin stopped because the final change in the sum of squares relative to

its initial value is less than the selected value of the function tolerance.

LG2Fparams =

0.5752 0.1181 0.0146 0.0119 -0.7895Create the G2PP object using LinearGaussian2F and use

Monte Carlo simulation to generate the interest-rate paths with

LinearGaussian2F.simTermStructs.

LG2f_a = LG2Fparams(1); LG2f_b = LG2Fparams(2); LG2f_sigma = LG2Fparams(3); LG2f_eta = LG2Fparams(4); LG2f_rho = LG2Fparams(5); G2PP = LinearGaussian2F(RateSpec,LG2f_a,LG2f_b,LG2f_sigma,LG2f_eta,LG2f_rho); G2PPSimPaths = G2PP.simTermStructs(nPeriods,'NTRIALS',nTrials,... 'DeltaTime',DeltaTime,'Tenor',Tenor,'antithetic',true); trialIdx = 1; figure surf(Tenor,SimDates,G2PPSimPaths(:,:,trialIdx)) datetick y keepticks keeplimits title(['Evolution of the Zero Curve for Trial:' num2str(trialIdx) ' of G2++ Model']) xlabel('Tenor (Years)')

Price the European swaption.

DF = exp(bsxfun(@times,-G2PPSimPaths,repmat(Tenor',[nPeriods+1 1]))); SwapRate = (1 - DF(exRow,endCol,:))./sum(bsxfun(@times,1,DF(exRow,1:endCol,:))); PayoffValue = 100*max(SwapRate-InstrumentStrike,0).*sum(bsxfun(@times,1,DF(exRow,1:endCol,:))); RealizedDF = prod(exp(bsxfun(@times,-G2PPSimPaths(1:exRow,1,:),SimTimes(1:exRow))),1); G2PP_SwaptionPrice = mean(RealizedDF.*PayoffValue)

G2PP_SwaptionPrice =

2.0988Simulate Interest-Rate Paths Using the LIBOR Market Model

This example shows how to simulate interest-rate paths using

the LIBOR market model. Before beginning this example that uses a

LiborMarketModel, make sure that you have set up the data

as described in:

The LIBOR Market Model (LMM) differs from short rate models in that it evolves a set of discrete forward rates. Specifically, the lognormal LMM specifies the following diffusion equation for each forward rate

where:

W is an N-dimensional geometric Brownian motion with

The LMM relates the drifts of the forward rates based on no-arbitrage arguments. Specifically, under the Spot LIBOR measure, the drifts are expressed as

where:

is the time fraction associated with the ith forward rate

q(t) is an index defined by the relation

and the Spot LIBOR numeraire is defined as

The choice with the LMM is how to model volatility and correlation and how to estimate the parameters of these models for volatility and correlation. In practice, you may use a combination of historical data (for example, observed correlation between forward rates) and current market data. For this example, only swaption data is used. Further, many different parameterizations of the volatility and correlation exist. For this example, two relatively straightforward parameterizations are used.

One of the most popular functional forms in the literature for volatility is:

where ϕ adjusts the curve to match the

volatility for the i th forward rate. For this example, all

of the ϕ’s are taken to be 1. For the

correlation, the following functional form is used:

Once the functional forms have been specified, these parameters must be estimated using market data. One useful approximation, initially developed by Rebonato, is the following, which relates the Black volatility for a European swaption, given a set of volatility functions and a correlation matrix

where:

This calculation is done using the function

blackvolbyrebonato to compute analytic values of the

swaption price for model parameters, and therefore, is then used to calibrate

the model. Calibration consists of minimizing the difference between the

observed implied swaption Black volatilities and the predicted Black

volatilities.

In this example, the approach is similar to Simulate Interest-Rate Paths Using the Hull-White One-Factor Model

and Simulate Interest-Rate Paths Using the Linear Gaussian Two-Factor Model where the Optimization Toolbox function lsqnonlin is used to minimize the

difference between the observed swaption prices and the predicted swaption

prices. However, other approaches (for example, simulated annealing) may also be

appropriate. Starting parameters and constraints for a,

b, d, and β are set

in the variables x0, lb, and

ub; these could also be varied depending upon the

particular calibration approach.

Calibrate the set of parameters that minimize the difference between the

observed and predicted values using blackvolbyrebonato and

lsqnonlin.

nRates = 10; CorrFunc = @(i,j,Beta) exp(-Beta*abs(i-j)); objfun = @(x) SwaptionBlackVol(relidx) - blackvolbyrebonato(RateSpec,... repmat({@(t) ones(size(t)).*(x(1)*t + x(2)).*exp(-x(3)*t) + x(4)},nRates-1,1),... CorrFunc(meshgrid(1:nRates-1)',meshgrid(1:nRates-1),x(5)),... EurExDatesFull(relidx),EurMatFull(relidx),'Period',1); options = optimset('disp','iter','MaxFunEvals',1000,'TolFun',1e-5); x0 = [.2 .05 1 .05 .2]; lb = [0 0 .5 0 .01]; ub = [1 1 2 .3 1]; LMMparams = lsqnonlin(objfun,x0,lb,ub,options)

Norm of First-order

Iteration Func-count f(x) step optimality

0 6 0.156251 0.483

1 12 0.00870177 0.188164 0.0339

2 18 0.00463441 0.165527 0.00095

3 24 0.00331055 0.351017 0.0154

4 30 0.00294775 0.0892617 7.47e-05

5 36 0.00281565 0.385779 0.00917

6 42 0.00278988 0.0145632 4.15e-05

7 48 0.00278522 0.115042 0.00116

Local minimum possible.

lsqnonlin stopped because the final change in the sum of squares relative to

its initial value is less than the selected value of the function tolerance.

LMMparams =

0.0781 0.1656 0.5121 0.0617 0.0100

Calculate VolFunc for the LMM

object.

a = LMMparams(1);

b = LMMparams(2);

c = LMMparams(3);

d = LMMparams(4);

Beta = LMMparams(5);

VolFunc = repmat({@(t) ones(size(t)).*(a*t + b).*exp(-c*t) + d},nRates-1,1);

Plot the volatility function.

figure

fplot(VolFunc{1},[0 20])

title('Volatility Function')

CorrelationMatrix = CorrFunc(meshgrid(1:nRates-1)',meshgrid(1:nRates-1),Beta);

Inspect the correlation matrix.

disp('Correlation Matrix') fprintf([repmat('%1.3f ',1,length(CorrelationMatrix)) ' \n'],CorrelationMatrix)

Correlation Matrix 1.000 0.990 0.980 0.970 0.961 0.951 0.942 0.932 0.923 0.990 1.000 0.990 0.980 0.970 0.961 0.951 0.942 0.932 0.980 0.990 1.000 0.990 0.980 0.970 0.961 0.951 0.942 0.970 0.980 0.990 1.000 0.990 0.980 0.970 0.961 0.951 0.961 0.970 0.980 0.990 1.000 0.990 0.980 0.970 0.961 0.951 0.961 0.970 0.980 0.990 1.000 0.990 0.980 0.970 0.942 0.951 0.961 0.970 0.980 0.990 1.000 0.990 0.980 0.932 0.942 0.951 0.961 0.970 0.980 0.990 1.000 0.990 0.923 0.932 0.942 0.951 0.961 0.970 0.980 0.990 1.000

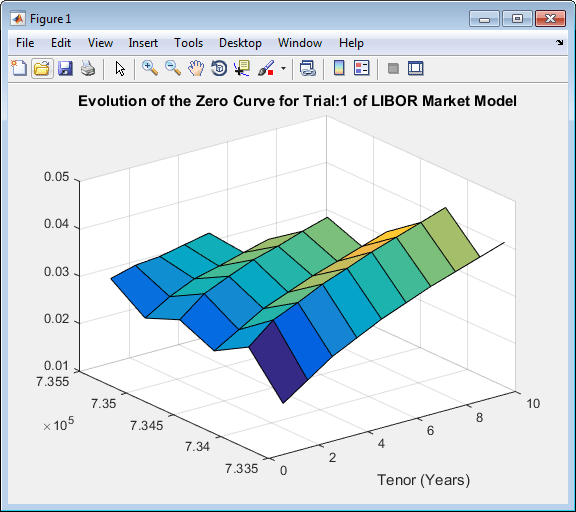

Create the LMM object using LiborMarketModel and use

Monte Carlo simulation to generate the interest-rate paths with

LiborMarketModel.simTermStructs.

LMM = LiborMarketModel(irdc,VolFunc,CorrelationMatrix,'Period',1); [LMMZeroRates, ForwardRates] = LMM.simTermStructs(nPeriods,'nTrials',nTrials); trialIdx = 1; figure tmpPlotData = LMMZeroRates(:,:,trialIdx); tmpPlotData(tmpPlotData == 0) = NaN; surf(Tenor,SimDates,tmpPlotData) title(['Evolution of the Zero Curve for Trial:' num2str(trialIdx) ' of LIBOR Market Model']) xlabel('Tenor (Years)')

Price the European swaption.

DF = exp(bsxfun(@times,-LMMZeroRates,repmat(Tenor',[nPeriods+1 1]))); SwapRate = (1 - DF(exRow,endCol,:))./sum(bsxfun(@times,1,DF(exRow,1:endCol,:))); PayoffValue = 100*max(SwapRate-InstrumentStrike,0).*sum(bsxfun(@times,1,DF(exRow,1:endCol,:))); RealizedDF = prod(exp(bsxfun(@times,-LMMZeroRates(2:exRow+1,1,:),SimTimes(1:exRow))),1); LMM_SwaptionPrice = mean(RealizedDF.*PayoffValue)

LMM_SwaptionPrice =

1.9915Compare Interest-Rate Modeling Results

This example shows how to compare the results for pricing a European swaption with different interest-rate models.

Compare the results for pricing a European swaption with interest-rate models using Monte Carlo simulation.

disp(' ') fprintf(' # of Monte Carlo Trials: %8d\n' , nTrials) fprintf(' # of Time Periods/Trial: %8d\n\n' , nPeriods) fprintf('HW1F European Swaption Price: %8.4f\n', HW1F_SwaptionPrice) fprintf('LG2F Europesn Swaption Price: %8.4f\n', G2PP_SwaptionPrice) fprintf(' LMM European Swaption Price: %8.4f\n', LMM_SwaptionPrice)

# of Monte Carlo Trials: 1000

# of Time Periods/Trial: 5

HW1F European Swaption Price: 2.1839

LG2F Europesn Swaption Price: 2.0988

LMM European Swaption Price: 1.9915References

Brigo, D. and F. Mercurio. Interest Rate Models - Theory and Practice with Smile, Inflation and Credit. Springer Finance, 2006.

Andersen, L. and V. Piterbarg. Interest Rate Modeling. Atlantic Financial Press. 2010.

Hull, J. Options, Futures, and Other Derivatives. Springer Finance, 2003.

Glasserman, P. Monte Carlo Methods in Financial Engineering. Prentice Hall, 2008.

Rebonato, R., K. McKay, and R. White. The Sabr/Libor Market Model: Pricing, Calibration and Hedging for Complex Interest-Rate Derivatives. John Wiley & Sons, 2010.

See Also

HullWhite1F | LinearGaussian2F | LiborMarketModel | simTermStructs | simTermStructs | simTermStructs | capbylg2f | floorbylg2f | swaptionbylg2f | swaptionbyhw | blackvolbyrebonato | lsqnonlin