Simulate Responses of Estimated VARX Model

This example shows how to estimate a multivariate time series model that contains lagged endogenous and exogenous variables, and how to simulate responses. The response series are the quarterly:

Changes in real gross domestic product (rGDP) rates ()

Real money supply (rM1SL) rates ()

Short-term interest rates (i.e., three-month treasury bill yield, )

from March, 1959 through March, 2009. The exogenous series is the quarterly changes in the unemployment rates ().

Suppose that a model for the responses is this VARX(4,3) model

Preprocess the Data

Load the U.S. macroeconomic data set. Flag the series and their periods that contain missing values (indicated by NaN values).

load Data_USEconModel varNaN = any(ismissing(DataTimeTable),1); % Variables containing NaN values seriesWithNaNs = series(varNaN)

seriesWithNaNs = 1×5 cell

{'(FEDFUNDS) Effective federal funds rate'} {'(GS10) Ten-year treasury bond yield'} {'(M1SL) M1 money supply (narrow money)'} {'(M2SL) M2 money supply (broad money)'} {'(UNRATE) Unemployment rate'}

In this data set, the variables that contain missing values entered the sample later than the other variables. There are no missing values after sampling started for a particular variable.

Flag all periods corresponding to missing values in the model variables.

idx = all(~ismissing(DataTimeTable(:,{'UNRATE' 'M1SL'})),2);For the rest of the example, consider only those values that of the series indicated by a true in idx.

Compute rGDP and rM1SL, and the growth rates of rGDP, rM1SL, short-term interest rates, and the unemployment rate. Description contains a description of the data and the variable names. Reserve the last three years of data to investigate the out-of-sample performance of the estimated model.

rGDP = DataTimeTable.GDP(idx)./(DataTimeTable.GDPDEF(idx)/100); rM1SL = DataTimeTable.M1SL(idx)./(DataTimeTable.GDPDEF(idx)/100); dLRGDP = diff(log(rGDP)); % rGDP growth rate dLRM1SL = diff(log(rM1SL)); % rM1SL growth rate d3MTB = diff(DataTimeTable.TB3MS(idx)); % Change in short-term interest rate (3MTB) dUNRATE = diff(DataTimeTable.UNRATE(idx)); % Change in unemployment rate T = numel(d3MTB); % Total sample size oosT = 12; % Out-of-sample size estT = T - oosT; % Estimation sample size estIdx = 1:estT; % Estimation sample indices oosIdx = (T - 11):T; % Out-of-sample indices dt = DataTimeTable.Time; dt = dt((end - T + 1):end); EstY = [dLRGDP(estIdx) dLRM1SL(estIdx) d3MTB(estIdx)]; % In-sample responses estX = dUNRATE(estIdx); % In-sample exogenous data n = size(EstY,2); OOSY = [dLRGDP(oosIdx) dLRM1SL(oosIdx) d3MTB(oosIdx)]; % Out-of-sample responses oosX = dUNRATE(oosIdx); % Out-of-sample exogenous data

Create VARX Model

Create a VARX(4) model using varm.

Mdl = varm(n,4);

Mdl is a varm model object serving as a template for estimation. Currently, Mdl does know have the structure in place for the regression component. However, MATLAB® creates the required structure during estimation.

Estimate the VAR(4) Model

Estimate the parameters of the VARX(4) model using estimate. Display the parameter estimates.

EstMdl = estimate(Mdl,EstY,'X',estX);

summarize(EstMdl)

AR-Stationary 3-Dimensional VARX(4) Model with 1 Predictor

Effective Sample Size: 184

Number of Estimated Parameters: 42

LogLikelihood: 1037.52

AIC: -1991.04

BIC: -1856.01

Value StandardError TStatistic PValue

___________ _____________ __________ __________

Constant(1) 0.0080266 0.00097087 8.2674 1.3688e-16

Constant(2) 0.00063838 0.0015942 0.40044 0.68883

Constant(3) 0.068361 0.143 0.47803 0.63263

AR{1}(1,1) -0.034045 0.06633 -0.51327 0.60776

AR{1}(2,1) -0.0024555 0.10891 -0.022546 0.98201

AR{1}(3,1) -1.7163 9.77 -0.17567 0.86056

AR{1}(1,2) -0.013882 0.046481 -0.29867 0.76519

AR{1}(2,2) 0.17753 0.076323 2.326 0.020017

AR{1}(3,2) -6.7572 6.8464 -0.98697 0.32366

AR{1}(1,3) 0.0010682 0.00048092 2.2212 0.026337

AR{1}(2,3) -0.0050252 0.00078967 -6.3636 1.9705e-10

AR{1}(3,3) -0.16256 0.070837 -2.2948 0.021744

AR{2}(1,1) 0.077748 0.064014 1.2145 0.22454

AR{2}(2,1) 0.0047257 0.10511 0.044959 0.96414

AR{2}(3,1) 3.4244 9.4289 0.36318 0.71647

AR{2}(1,2) 0.077867 0.046954 1.6584 0.097245

AR{2}(2,2) 0.29087 0.077099 3.7727 0.00016148

AR{2}(3,2) 0.39284 6.9161 0.0568 0.9547

AR{2}(1,3) -0.0010719 0.00056413 -1.9001 0.057423

AR{2}(2,3) -0.0016135 0.00092631 -1.7419 0.081533

AR{2}(3,3) -0.21556 0.083094 -2.5942 0.0094802

AR{3}(1,1) -0.090881 0.062563 -1.4526 0.14633

AR{3}(2,1) 0.064249 0.10273 0.62542 0.53169

AR{3}(3,1) -7.9727 9.2152 -0.86517 0.38695

AR{3}(1,2) -0.024092 0.04631 -0.52024 0.60289

AR{3}(2,2) 0.068565 0.076041 0.90168 0.36723

AR{3}(3,2) 10.263 6.8212 1.5046 0.13242

AR{3}(1,3) -0.00055981 0.00056073 -0.99836 0.31811

AR{3}(2,3) -0.0021302 0.00092073 -2.3136 0.02069

AR{3}(3,3) 0.22969 0.082593 2.7809 0.0054203

AR{4}(1,1) 0.066151 0.056841 1.1638 0.24451

AR{4}(2,1) 0.028826 0.093334 0.30885 0.75744

AR{4}(3,1) 1.0379 8.3724 0.12397 0.90134

AR{4}(1,2) -0.078735 0.043804 -1.7975 0.072263

AR{4}(2,2) 0.0096425 0.071926 0.13406 0.89335

AR{4}(3,2) -12.007 6.4521 -1.8609 0.062761

AR{4}(1,3) -0.00018454 0.00053356 -0.34586 0.72945

AR{4}(2,3) -0.00019036 0.00087611 -0.21728 0.82799

AR{4}(3,3) 0.053812 0.078591 0.68471 0.49353

Beta(1,1) -0.016084 0.0016037 -10.029 1.1365e-23

Beta(2,1) -0.00154 0.0026333 -0.58482 0.55867

Beta(3,1) -1.5317 0.23622 -6.4841 8.9252e-11

Innovations Covariance Matrix:

0.0000 0.0000 0.0000

0.0000 0.0001 -0.0019

0.0000 -0.0019 0.7790

Innovations Correlation Matrix:

1.0000 0.1198 0.0011

0.1198 1.0000 -0.2177

0.0011 -0.2177 1.0000

EstMdl is a varm model object containing the estimated parameters.

Simulate Out-Of-Sample Response Paths

Simulate 1000, 3 year response series paths from the estimated model assuming that the exogenous unemployment rate is a fixed series. Since the model contains 4 lags per endogenous variable, specify the last 4 observations in the estimation sample as presample data.

numPaths = 1000; Y0 = EstY((end-3):end,:); rng(1); % For reproducibility YSim = simulate(EstMdl,oosT,'X',oosX,'Y0',Y0,'NumPaths',numPaths);

YSim is a 12-by-3-by-1000 numeric array of simulated responses. The rows of YSim correspond to out-of-sample periods, the columns correspond to the response series, and the pages correspond to paths.

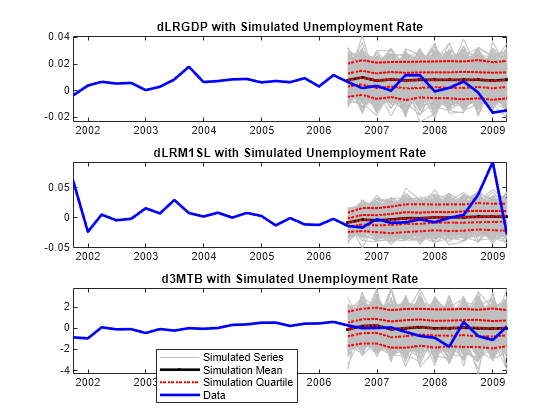

Plot the response data and the simulated responses. Identify the 5%, 25%, 75% and 95% percentiles, and the mean and median of the simulated series at each out-of-sample period.

YSimBar = mean(YSim,3);

YSimQrtl = quantile(YSim,[0.05 0.25 0.5 0.75 0.95],3);

respNames = {'dLRGDP' 'dLRM1SL' 'd3MTB'};

figure;

for j = 1:n

subplot(3,1,j);

h1 = plot(dt(oosIdx),squeeze(YSim(:,j,:)),'Color',0.75*ones(3,1));

hold on

h2 = plot(dt(oosIdx),YSimBar(:,j),'.-k','LineWidth',2);

h3 = plot(dt(oosIdx),squeeze(YSimQrtl(:,j,:)),':r','LineWidth',1.5);

h4 = plot(dt((end - 30):end),[EstY((end - 18):end,j);OOSY(:,j)],...

'b','LineWidth',2);

title(sprintf('%s',respNames{j}));

axis tight

hold off

end

legend([h1(1) h2(1) h3(1) h4],{'Simulated Series','Simulation Mean',...

'Simulation Quartile','Data'},'Location',[0.4 0.1 0.01 0.01],...

'FontSize',8);

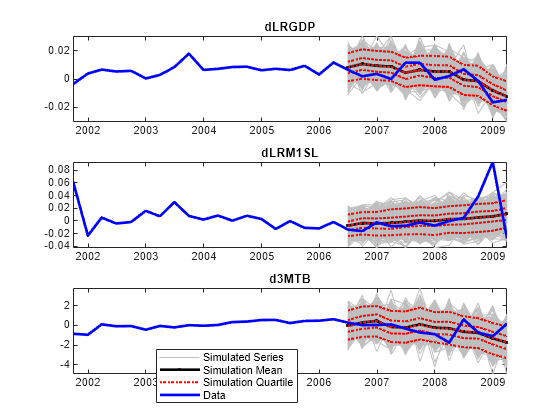

Simulate Out-Of-Sample Response Paths Using Random Exogenous Data

Suppose that the change in the unemployment rate is an AR(4) model, and fit the model to the estimation sample data.

MdlUNRATE = arima('ARLags',1:4); EstMdlUNRATE = estimate(MdlUNRATE,estX,'Display','off');

EstMdlUNRATE is an arima model object containing the parameter estimates.

Simulate 1000, 3 year paths from the estimated AR(4) model for the change in unemployment rate. Since the model contains 4 lags, specify the last 4 observations in the estimation sample as presample data.

XSim = simulate(EstMdlUNRATE,oosT,'Y0',estX(end-3:end),... 'NumPaths',numPaths);

XSim is a 12-by-1000 numeric matrix of simulated exogenous paths. The rows correspond to periods and the columns correspond to paths.

Simulate 3 years of 1000 future response series paths from the estimated model using the simulated exogenous data. simulate does not accept multiple paths of predictor data, so you must simulate responses in a loop. Since the model contains 4 lags per endogenous variable, specify the last 4 observations in the estimation sample as presample data.

YSimRX = zeros(oosT,n,numPaths); % Preallocate for j = 1:numPaths YSimRX(:,:,j) = simulate(EstMdl,oosT,'X',XSim(:,j),'Y0',Y0); end

YSimRX is a 12-by-3-by-1000 numeric array of simulated responses.

Plot the response data and the simulated responses. Identify the 5%, 25%, 75% and 95% percentiles, and the mean and median of the simulated series at each out-of-sample period.

YSimBarRX = mean(YSimRX,3); YSimQrtlRX = quantile(YSimRX,[0.05 0.25 0.5 0.75 0.95],3); figure; for j = 1:n subplot(3,1,j); h1 = plot(dt(oosIdx),squeeze(YSimRX(:,j,:)),'Color',0.75*ones(3,1)); hold on h2 = plot(dt(oosIdx),YSimBarRX(:,j),'.-k','LineWidth',2); h3 = plot(dt(oosIdx),squeeze(YSimQrtlRX(:,j,:)),':r','LineWidth',1.5); h4 = plot(dt((end - 30):end),[EstY((end - 18):end,j);OOSY(:,j)],... 'b','LineWidth',2); title(sprintf('%s with Simulated Unemployment Rate Change',respNames{j})); axis tight hold off end legend([h1(1) h2(1) h3(1) h4],{'Simulated Series','Simulation Mean',... 'Simulation Quartile','Data'},'Location',[0.4 0.1 0.01 0.01],... 'FontSize',8)