Apply the Baxter-King filter to all variables in input table variables.

Load the Schwert stock data set Data_SchwertStock.mat, which contains monthly returns of the NYSE index from 1871 through 2008 in DataTimeTableMth, among three other variables (for details, enter Description). Remove all missing observations from all series.

Aggregate the monthly data in the timetable to quarterly measurements.

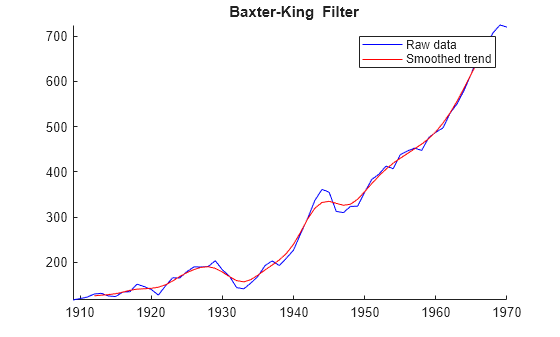

Apply the Baxter-King filter to all variables in the quarterly timetable. Use the default cutoffs and lag length for the moving average.

TQTT and CQTT are 220-by-4 timetables containing the trend and cyclical components, respectively, of the series in TTQ. Variables in the input and output timetables correspond. By default, bkfilter filters all variables in the input table or timetable. To select a subset of variables, set the DataVariables option.

The default lag length is 12. Consequently, the first and last 12 rows in the output timetable are NaN-valued.

Remove the leading and lagging NaNs from the trends and display what remains.

TQTTCut=196×4 timetable

Time Return DivYld CapGain CapGainA

___________ __________ _________ __________ __________

31-Mar-1874 -0.039822 0.0032538 -0.028711 -0.043076

30-Jun-1874 -0.017105 0.0044321 -0.023919 -0.021537

30-Sep-1874 0.0039487 0.0010179 0.002954 0.0029307

31-Dec-1874 -0.0078419 0.0050448 -0.0063275 -0.012887

31-Mar-1875 0.020326 0.0024432 0.015128 0.017883

30-Jun-1875 -0.0020712 0.0038703 -0.017158 -0.0059416

30-Sep-1875 -0.0085514 0.0044146 -0.01171 -0.012966

31-Dec-1875 -0.006103 0.0036185 -0.0058395 -0.0097214

31-Mar-1876 -0.0055681 0.0031237 -0.0059341 -0.0086918

30-Jun-1876 0.013271 0.0044001 0.0034571 0.0088705

30-Sep-1876 -0.033603 0.0042907 -0.03317 -0.037894

31-Dec-1876 0.04053 0.0045942 0.031644 0.035936

31-Mar-1877 0.0023469 0.0032843 -0.014032 -0.0009374

30-Jun-1877 -0.061762 0.004893 -0.049214 -0.066655

30-Sep-1877 0.066959 0.0047892 0.058975 0.06217

31-Dec-1877 -0.017554 0.0029106 -0.026179 -0.020464

⋮

CQTTCut=196×4 timetable

Time Return DivYld CapGain CapGainA

___________ __________ ___________ __________ __________

31-Mar-1874 0.01699 -0.00117 0.015758 0.01816

30-Jun-1874 0.020025 -0.0013329 0.018379 0.021358

30-Sep-1874 0.016201 -0.00079002 0.013713 0.016991

31-Dec-1874 0.0064867 1.9907e-06 0.0036027 0.0064847

31-Mar-1875 -0.002434 0.00036989 -0.0041687 -0.0028039

30-Jun-1875 -0.0061591 3.1258e-05 -0.0050638 -0.0061903

30-Sep-1875 -0.0033857 -0.00076308 0.00044226 -0.0026226

31-Dec-1875 0.0015781 -0.0013475 0.0058395 0.0029255

31-Mar-1876 0.0017405 -0.0010938 0.0031869 0.0028343

30-Jun-1876 -0.0062558 1.9708e-05 -0.0094095 -0.0062755

30-Sep-1876 -0.021212 0.0013923 -0.026956 -0.022604

31-Dec-1876 -0.034671 0.0023024 -0.03854 -0.036974

31-Mar-1877 -0.039779 0.0023122 -0.038012 -0.042091

30-Jun-1877 -0.028847 0.0017301 -0.022516 -0.030577

30-Sep-1877 -0.003445 0.0011069 0.0022493 -0.0045519

31-Dec-1877 0.023547 0.00090623 0.022362 0.022641

⋮

To compare outputs between different tabular inputs, apply the Baxter-King filter to all variables in the table of monthly data DataTableMth and the timetable of monthly data TTM.

Return DivYld CapGain CapGainA

__________ _________ __________ __________

May1924 -0.0016302 0.002973 -0.0046032 -0.0046032

Jun1924 0.047692 0.0065778 0.041115 0.041115

Jul1924 0.044844 0.0060522 0.038792 0.038792

Aug1924 0.010929 0.0019358 0.0089936 0.0089936

Sep1924 -0.0086959 0.006971 -0.015667 -0.015667

Oct1924 -0.0014852 0.0049456 -0.0064308 -0.0064308

Nov1924 0.062927 0.0020931 0.060834 0.060834

Dec1924 0.045108 0.0070319 0.038076 0.038076

Return DivYld CapGain CapGainA

_________ ___________ _________ _________

May1924 0.0074662 -4.9042e-05 0.0075152 0.0075152

Jun1924 0.017044 0.00019971 0.016844 0.016844

Jul1924 0.016657 0.00028124 0.016376 0.016376

Aug1924 0.0096193 0.00019693 0.0094224 0.0094224

Sep1924 0.0035508 0.00014389 0.0034069 0.0034069

Oct1924 0.0064063 7.9476e-05 0.0063268 0.0063268

Nov1924 0.013666 7.2083e-05 0.013594 0.013594

Dec1924 0.015515 0.00010861 0.015407 0.015407

Time Return DivYld CapGain CapGainA

___________ __________ _________ __________ __________

01-May-1924 -0.0016302 0.002973 -0.0046032 -0.0046032

01-Jun-1924 0.047692 0.0065778 0.041115 0.041115

01-Jul-1924 0.044844 0.0060522 0.038792 0.038792

01-Aug-1924 0.010929 0.0019358 0.0089936 0.0089936

01-Sep-1924 -0.0086959 0.006971 -0.015667 -0.015667

01-Oct-1924 -0.0014852 0.0049456 -0.0064308 -0.0064308

01-Nov-1924 0.062927 0.0020931 0.060834 0.060834

01-Dec-1924 0.045108 0.0070319 0.038076 0.038076

Time Return DivYld CapGain CapGainA

___________ _________ ___________ _________ _________

01-May-1924 0.0074662 -4.9042e-05 0.0075152 0.0075152

01-Jun-1924 0.017044 0.00019971 0.016844 0.016844

01-Jul-1924 0.016657 0.00028124 0.016376 0.016376

01-Aug-1924 0.0096193 0.00019693 0.0094224 0.0094224

01-Sep-1924 0.0035508 0.00014389 0.0034069 0.0034069

01-Oct-1924 0.0064063 7.9476e-05 0.0063268 0.0063268

01-Nov-1924 0.013666 7.2083e-05 0.013594 0.013594

01-Dec-1924 0.015515 0.00010861 0.015407 0.015407

Because the data is disaggregated, the outputs of the daily data have more rows than from the quarterly data. The filter results of the daily inputs are equal among the corresponding outputs, but bkfilter returns tables of results, instead of timetables, when you supply data in a table.