simulate

Monte Carlo simulation of univariate ARIMA or ARIMAX models

Syntax

Description

Y = simulate(Mdl,numobs,Name=Value)simulate returns numeric arrays when all optional input data are

numeric arrays. For example, simulate(Mdl,100,NumPaths=1000,Y0=PS)

returns a numeric array of 1000, 100-period simulated response paths from

Mdl and specifies the numeric array of presample response data

PS.

[

uses any input-argument combination in the previous syntaxes to return numeric arrays of

one or more independent series of model innovations Y,E,V] = simulate(___)E and, when

Mdl represents a composite conditional mean and variance model,

conditional variances V, resulting from simulating the ARIMA

model.

Tbl = simulate(Mdl,numobs,Presample=Presample,PresampleResponseVariable=PresampleResponseVariable)Tbl containing a variable for each of

the random paths of response, innovation, and conditional variance series resulting from

simulating the ARIMA model Mdl. simulate uses

the response variable PresampleResponseVariable in the table or

timetable of presample data Presample to initialize the response

series. (since R2023b)

To initialize the model using presample innovation or conditional variance data,

replace the PresampleResponseVariable name-value argument with

PresampleInnovationVariable or

PresampleVarianceVariable name-value argument.

Tbl = simulate(Mdl,numobs,InSample=InSample,PredictorVariables=PredictorVariables)PredictorVariables in the in-sample table or

timetable of data InSample containing the predictor data for the

exogenous regression component in the ARIMA model Mdl. (since R2023b)

Tbl = simulate(Mdl,numobs,Presample=Presample,PresampleResponseVariable=PresampleResponseVariable,InSample=InSample,PredictorVariables=PredictorVariables)

Tbl = simulate(___,Name=Value)

For example,

simulate(Mdl,100,NumPaths=1000,Presample=PSTbl,PresampleResponseVariables="GDP")

returns a timetable containing a variable for each of the response, innovations, and

conditional variance series. Each variable is a 100-by-1000 matrix representing 1000,

100-period paths simulated from the ARIMA model. simulate

initializes the model by using the presample data in the GDP variable

of the timetable PSTbl.

Examples

Simulate a response path from an ARIMA model. Return the path in a vector.

Consider the ARIMA(4,1,1) model

where is a Gaussian innovations series with a mean of 0 and a variance of 1.

Create the ARIMA(4,1,1) model.

Mdl = arima(AR=-0.75,ARLags=4,MA=0.1,Constant=2,Variance=1)

Mdl =

arima with properties:

Description: "ARIMA(4,0,1) Model (Gaussian Distribution)"

SeriesName: "Y"

Distribution: Name = "Gaussian"

P: 4

D: 0

Q: 1

Constant: 2

AR: {-0.75} at lag [4]

SAR: {}

MA: {0.1} at lag [1]

SMA: {}

Seasonality: 0

Beta: [1×0]

Variance: 1

Mdl is a fully specified arima object representing the ARIMA(4,1,1) model.

Simulate a 100-period random response path from the ARIMA(4,1,1) model.

rng(1,"twister") % For reproducibility y = simulate(Mdl,100);

y is a 100-by-1 vector containing the random response path.

Plot the simulated path.

plot(y) ylabel("y") xlabel("Time")

Simulate three predictor series and a response series.

Specify and simulate a path of length 20 for each of the three predictor series modeled by

where follows a Gaussian distribution with mean 0 and variance 0.01, and = {1,2,3}.

[MdlX1,MdlX2,MdlX3] = deal(arima(AR=0.2,MA={0.5 -0.3}, ...

Constant=2,Variance=0.01));

rng(4,"twister"); % For reproducibility

simX1 = simulate(MdlX1,20);

simX2 = simulate(MdlX2,20);

simX3 = simulate(MdlX3,20);

SimX = [simX1 simX2 simX3];Specify and simulate a path of length 20 for the response series modeled by

where follows a Gaussian distribution with mean 0 and variance 1.

MdlY = arima(AR={0.05 -0.02 0.01},MA={0.04 0.01}, ...

D=1,Constant=0.5,Variance=1,Beta=[0.5 -0.03 -0.7]);

simY = simulate(MdlY,20,X=SimX);Plot the series together.

figure plot([SimX simY]) title("Simulated Series") legend("x_1","x_2","x_3","y")

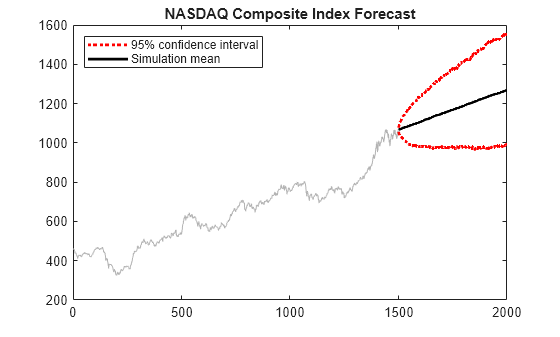

Forecast the daily NASDAQ Composite Index using Monte Carlo simulations. Supply presample observations to initialize the model.

Load the NASDAQ data included with the toolbox. Extract the first 1500 observations for fitting.

load Data_EquityIdx

nasdaq = DataTable.NASDAQ(1:1500);

T = length(nasdaq);Fit an ARIMA(1,1,1) model.

NasdaqModel = arima(1,1,1); NasdaqFit = estimate(NasdaqModel,nasdaq);

ARIMA(1,1,1) Model (Gaussian Distribution):

Value StandardError TStatistic PValue

_________ _____________ __________ __________

Constant 0.43031 0.18555 2.319 0.020393

AR{1} -0.074391 0.081985 -0.90737 0.36421

MA{1} 0.31126 0.077266 4.0284 5.6158e-05

Variance 27.826 0.63625 43.735 0

Simulate 1000 paths with 500 observations each. Use the observed data as presample data.

rng(1,"twister");

Y = simulate(NasdaqFit,500,NumPaths=1000,Y0=nasdaq);Plot the simulation mean forecast and approximate 95% forecast intervals.

lower = prctile(Y,2.5,2); upper = prctile(Y,97.5,2); mn = mean(Y,2); x = T + (1:500); figure plot(nasdaq,Color=[.7,.7,.7]) hold on h1 = plot(x,lower,"r:",LineWidth=2); plot(x,upper,"r:",LineWidth=2) h2 = plot(x,mn,"k",LineWidth=2); legend([h1 h2],"95% confidence interval","Simulation mean", ... Location="NorthWest") title("NASDAQ Composite Index Forecast") hold off

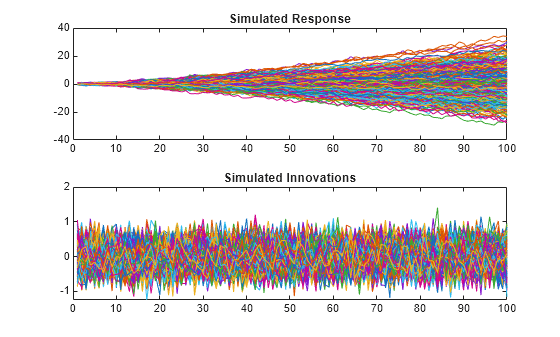

Simulate response and innovation paths from a multiplicative seasonal model.

Specify the model

where follows a Gaussian distribution with mean 0 and variance 0.1.

Mdl = arima(MA=-0.5,SMA=0.3,SMALags=12,D=1, ...

Seasonality=12,Variance=0.1,Constant=0);Simulate 500 paths with 100 observations each.

rng(1,"twister") % For reproducibility [Y,E] = simulate(Mdl,100,NumPaths=500); figure tiledlayout(2,1) nexttile plot(Y) title("Simulated Response") nexttile plot(E) title("Simulated Innovations")

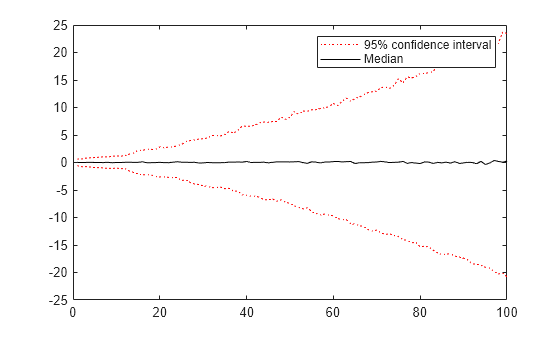

Plot the 2.5th, 50th (median), and 97.5th percentiles of the simulated response paths.

lower = prctile(Y,2.5,2); middle = median(Y,2); upper = prctile(Y,97.5,2); figure plot(1:100,lower,"r:",1:100,middle,"k", ... 1:100,upper,"r:") legend("95% confidence interval","Median")

Compute statistics across the second dimension (across paths) to summarize the sample paths.

Plot a histogram of the simulated paths at time 100.

figure

histogram(Y(100,:),10)

title("Response Distribution at Time 100")

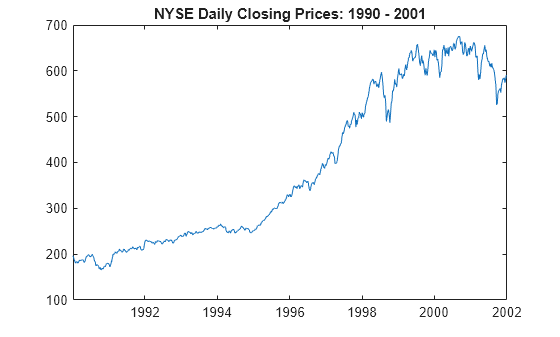

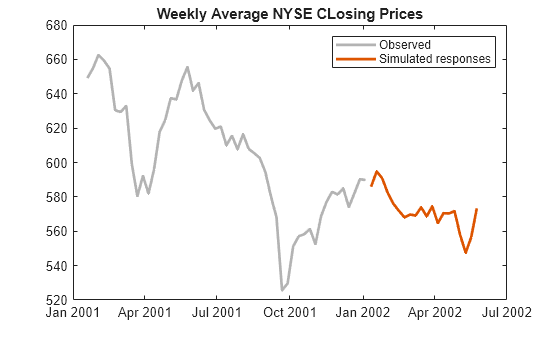

Fit an ARIMA(1,1,1) model to the weekly average NYSE closing prices. Supply a timetable of presample responses to initialize the model and return a timetable of simulated values from the model.

Load Data

Load the US equity index data set Data_EquityIdx.

load Data_EquityIdx

T = height(DataTimeTable)T = 3028

The timetable DataTimeTable includes the time series variable NYSE, which contains daily NYSE composite closing prices from January 1990 through December 2001.

Plot the daily NYSE price series.

figure

plot(DataTimeTable.Time,DataTimeTable.NYSE)

title("NYSE Daily Closing Prices: 1990 - 2001")

Prepare Timetable for Estimation

When you plan to supply a timetable, you must ensure it has all the following characteristics:

The selected response variable is numeric and does not contain any missing values.

The timestamps in the

Timevariable are regular, and they are ascending or descending.

Remove all missing values from the timetable, relative to the NYSE price series.

DTT = rmmissing(DataTimeTable,DataVariables="NYSE");

T_DTT = height(DTT)T_DTT = 3028

Because all sample times have observed NYSE prices, rmmissing does not remove any observations.

Determine whether the sampling timestamps have a regular frequency and are sorted.

areTimestampsRegular = isregular(DTT,"days")areTimestampsRegular = logical

0

areTimestampsSorted = issorted(DTT.Time)

areTimestampsSorted = logical

1

areTimestampsRegular = 0 indicates that the timestamps of DTT are irregular. areTimestampsSorted = 1 indicates that the timestamps are sorted. Business day rules make daily macroeconomic measurements irregular.

Remedy the time irregularity by computing the weekly average closing price series of all timetable variables.

DTTW = convert2weekly(DTT,Aggregation="mean"); areTimestampsRegular = isregular(DTTW,"weeks")

areTimestampsRegular = logical

1

T_DTTW = height(DTTW)

T_DTTW = 627

DTTW is regular.

figure

plot(DTTW.Time,DTTW.NYSE)

title("NYSE Daily Closing Prices: 1990 - 2001")

Create Model Template for Estimation

Suppose that an ARIMA(1,1,1) model is appropriate to model NYSE composite series during the sample period.

Create an ARIMA(1,1,1) model template for estimation.

Mdl = arima(1,1,1);

Mdl is a partially specified arima model object.

Fit Model to Data

infer requires Mdl.P presample observations to initialize the model. infer backcasts for necessary presample responses, but you can provide a presample.

Partition the data into presample and in-sample, or estimation sample, observations.

T0 = Mdl.P; DTTW0 = DTTW(1:T0,:); DTTW1 = DTTW((T0+1):end,:);

Fit an ARIMA(1,1,1) model to the in-sample weekly average NYSE closing prices. Specify the response variable name, presample timetable, and the presample response variable name.

EstMdl = estimate(Mdl,DTTW1,ResponseVariable="NYSE", ... Presample=DTTW0,PresampleResponseVariable="NYSE");

ARIMA(1,1,1) Model (Gaussian Distribution):

Value StandardError TStatistic PValue

________ _____________ __________ ___________

Constant 0.83623 0.453 1.846 0.064892

AR{1} -0.32862 0.23526 -1.3968 0.16246

MA{1} 0.42703 0.22613 1.8885 0.058964

Variance 56.065 1.8433 30.416 3.3806e-203

EstMdl is a fully specified, estimated arima model object.

Simulate Model

Simulate the fitted model 20 weeks beyond the final period. Specify the entire in-sample data as a presample and the presample response variable name in the in-sample timetable.

rng(1,"twister") % For reproducibility numobs = 20; Tbl = simulate(EstMdl,numobs,Presample=DTTW1, ... PresampleResponseVariable="NYSE"); tail(Tbl)

Time Y_Response Y_Innovation Y_Variance

___________ __________ ____________ __________

05-Apr-2002 564.68 -11.302 56.065

12-Apr-2002 570.47 6.5582 56.065

19-Apr-2002 570.39 -1.8179 56.065

26-Apr-2002 571.72 1.249 56.065

03-May-2002 557.94 -14.716 56.065

10-May-2002 547.51 -9.5098 56.065

17-May-2002 556.51 8.7992 56.065

24-May-2002 573.34 15.194 56.065

size(Tbl)

ans = 1×2

20 3

Tbl is a 20-by-3 timetable containing the simulated response path NYSE_Response, the corresponding simulated innovation path NYSE_Innovation, and the constant variance path NYSE_Variance (Mdl.Variance = 56.065).

Plot the simulated responses.

figure plot(DTTW1.Time((end-50):end),DTTW1.NYSE((end-50):end), ... Color=[0.7 0.7 0.7],LineWidth=2); hold on plot(Tbl.Time,Tbl.Y_Response,LineWidth=2); legend("Observed","Simulated responses") title("Weekly Average NYSE CLosing Prices") hold off

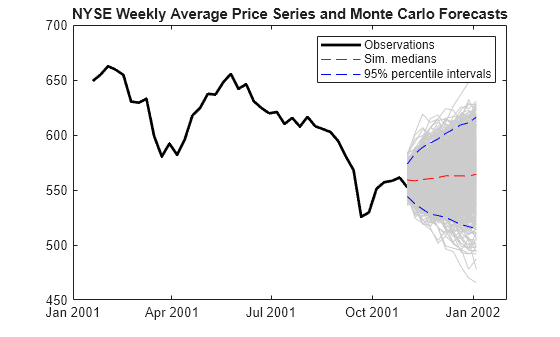

Fit an ARIMAX(1,1,1) model to the weekly average NYSE closing prices. Include an exogenous regression term identifying whether a measurement observation occurs during a recession. Supply timetables of presample and in-sample exogenous data. Simulate the weekly average closing prices over a 10-week horizon, and compare the forecasts to held out data.

Load the US equity index data set Data_EquityIdx.

load Data_EquityIdx

T = height(DataTimeTable)T = 3028

Remedy the time irregularity by computing the weekly average closing price series of all timetable variables.

DTTW = convert2weekly(DataTimeTable,Aggregation="mean");

T_DTTW = height(DTTW)T_DTTW = 627

Load the US recessions data set.

load Data_Recessions RDT = datetime(Recessions,ConvertFrom="datenum", ... Format="yyyy-MM-dd");

Determine whether each sampling time in the data occurs during a US recession.

isrecession = @(x)any(isbetween(x,RDT(:,1),RDT(:,2))); DTTW.IsRecession = arrayfun(isrecession,DTTW.Time)*1;

DTTW contains a variable IsRecession, which represents the exogenous variable in the ARIMAX model.

Create an ARIMA(1,1,1) model template for estimation. Set the response series name to NYSE.

Mdl = arima(1,1,1);

Mdl.SeriesName = "NYSE";Partition the data into required presample, in-sample (estimation sample), and 10 holdout sample observations.

T0 = Mdl.P; T2 = 10; DTTW0 = DTTW(1:T0,:); DTTW1 = DTTW((T0+1):(end-T2),:); DTTW2 = DTTW((end-T2+1):end,:);

Fit an ARIMA(1,1,1) model to the in-sample weekly average NYSE closing prices. Specify the presample timetable, the presample response variable name, and the in-sample predictor variable name.

EstMdl = estimate(Mdl,DTTW1,Presample=DTTW0,PresampleResponseVariable="NYSE", ... PredictorVariables="IsRecession");

ARIMAX(1,1,1) Model (Gaussian Distribution):

Value StandardError TStatistic PValue

________ _____________ __________ ___________

Constant 1.0635 0.50013 2.1264 0.033468

AR{1} -0.33828 0.2088 -1.6201 0.1052

MA{1} 0.43879 0.20045 2.189 0.028593

Beta(1) -2.425 1.0861 -2.2327 0.02557

Variance 55.527 1.9255 28.838 7.0988e-183

Simulate 1000 paths of responses from the fitted model into a 10-week horizon. Specify the in-sample data as a presample, the presample response variable name, the predictor data in the forecast horizon, and the predictor variable name.

rng(1,"twister") Tbl = simulate(EstMdl,T2,Presample=DTTW1,PresampleResponseVariable="NYSE", ... InSample=DTTW2,PredictorVariables="IsRecession",NumPaths=1000);

Tbl is a 10-by-6 timetable containing all variables in InSample, and the following variables:

NYSE_Response: a 10-by-1000 matrix of 1000 random response paths simulated from the model.NYSE_Innovation: a 10-by-1000 matrix of 1000 random innovation paths filtered through the model to product the response pathsNYSE_Variance: a 10-by-1000 matrix containing only the constantMdl.Variance = 55.527.

Plot the observed responses, median of the simulated responses, a 95% percentile intervals of the simulated values.

SimStats = quantile(Tbl.NYSE_Response,[0.025 0.5 0.975],2); figure h1 = plot(DTTW.Time((end-50):end),DTTW.NYSE((end-50):end),"k",LineWidth=2); hold on plot(Tbl.Time,Tbl.NYSE_Response,Color=[0.8 0.8 0.8]) h2 = plot(Tbl.Time,SimStats(:,2),'r--'); h3 = plot(Tbl.Time,SimStats(:,[1 3]),'b--'); legend([h1 h2 h3(1)],["Observations" "Sim. medians" "95% percentile intervals"]) title("NYSE Weekly Average Price Series and Monte Carlo Forecasts")

Input Arguments

Sample path length, specified as a positive integer. numobs is the number of random observations to generate per output path.

Data Types: double

Since R2023b

Presample data containing paths of responses

yt, innovations

εt, or conditional variances

σt2 to

initialize the model, specified as a table or timetable with

numprevars variables and numpreobs rows.

simulate returns the simulated variables in the output table

or timetable Tbl, which is the same type as

Presample. If Presample is a timetable,

Tbl is a timetable that immediately follows

Presample in time with respect to the sampling frequency.

Each selected variable is a single path (numpreobs-by-1 vector)

or multiple paths (numpreobs-by-numprepaths

matrix) of numpreobs observations representing the presample of

numpreobs observations of responses, innovations, or conditional

variances.

Each row is a presample observation, and measurements in each row occur

simultaneously. The last row contains the latest presample observation.

numpreobs must be one of the following values:

At least

Mdl.PwhenPresampleprovides only presample responsesAt least

Mdl.QwhenPresampleprovides only presample disturbances or conditional variancesAt least

max([Mdl.P Mdl.Q])otherwise

When Mdl.Variance is a conditional variance model,

simulate can require more than the minimum required number of

presample values.

If numpreobs exceeds the minimum number,

simulate uses the latest required number of observations

only.

If numprepaths > NumPaths,

simulate uses only the first NumPaths

columns.

If Presample is a timetable, all the following conditions must

be true:

If Presample is a table, the last row contains the latest

presample observation.

By default, simulate sets the following values:

For necessary presample responses:

The unconditional mean of the model when

Mdlrepresents a stationary AR process without a regression componentZero when

Mdlrepresents a nonstationary process or when it contains a regression component.

For necessary presample disturbances, zero.

For necessary presample conditional variances, the unconditional variance of the conditional variance model n

Mdl.Variance.

If you specify the Presample, you must specify the presample

response, innovation, or conditional variance variable name by using the

PresampleResponseVariable,

PresampleInnovationVariable, or

PresampleVarianceVariable name-value argument.

Since R2023b

Response variable yt to select from

Presample containing presample response data, specified as one of

the following data types:

String scalar or character vector containing a variable name in

Presample.Properties.VariableNamesVariable index (positive integer) to select from

Presample.Properties.VariableNamesA logical vector, where

PresampleResponseVariable(selects variablej) = truejPresample.Properties.VariableNames

The selected variable must be a numeric matrix and cannot contain missing values

(NaNs).

If you specify presample response data by using the Presample

name-value argument, you must specify

PresampleResponseVariable.

Example: PresampleResponseVariable="Stock0"

Example: PresampleResponseVariable=[false false true false] or

PresampleResponseVariable=3 selects the third table variable as

the presample response variable.

Data Types: double | logical | char | cell | string

Since R2023b

In-sample predictor data for the exogenous regression component of the model,

specified as a table or timetable. InSample contains

numvars variables, including numpreds predictor

variables xt.

simulate returns the simulated variables in the output table

or timetable Tbl, which is commensurate with

InSample.

Each row corresponds to an observation in the simulation horizon, the first row is

the earliest observation, and measurements in each row, among all paths, occur

simultaneously. InSample must have at least

numobs rows to cover the simulation horizon. If you supply more

rows than necessary, simulate uses only the first

numobs rows.

Each selected predictor variable is a numeric vector without missing values

(NaNs). All predictor variables are present in the regression

component of each response equation and apply to all response paths.

If InSample is a timetable, the following conditions apply:

If InSample is a table, the last row contains the latest

observation.

By default, simulate does not include the regression

component in the model, regardless of the value of Mdl.Beta.

Exogenous predictor variables xt to select

from InSample containing predictor data for the regression component,

specified as one of the following data types:

String vector or cell vector of character vectors containing

numpredsvariable names inInSample.Properties.VariableNamesA vector of unique indices (positive integers) of variables to select from

InSample.Properties.VariableNamesA logical vector, where

PredictorVariables(selects variablej) = truejInSample.Properties.VariableNames

The selected variables must be numeric vectors and cannot contain missing values

(NaNs).

By default, simulate excludes the regression component,

regardless of its presence in Mdl.

Example: PredictorVariables=["M1SL" "TB3MS"

"UNRATE"]

Example: PredictorVariables=[true false true false] or

PredictorVariable=[1 3] selects the first and third table variables

to supply the predictor data.

Data Types: double | logical | char | cell | string

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: simulate(Mdl,10,NumPaths=1000,Y0=y0) simulates

1000 sample paths of length 10 from the ARIMA model

Mdl, and uses the observations in y0 as a presample

to initialize each generated path.

Number of independent sample paths to generate, specified as a positive integer.

Example: NumPaths=1000

Data Types: double

Presample response data yt used as

initial values for the model, specified as a numpreobs-by-1 numeric

column vector or a numpreobs-by-numprepaths

numeric matrix. Use Y0 only when you supply optional data inputs as

numeric arrays.

numpreobs is the number of presample observations.

numprepaths is the number of presample response paths.

Each row is a presample observation (sampling time), and measurements in each row

occur simultaneously. The last row contains the latest presample observation.

numpreobs must be at least Mdl.P to initialize

the AR model component. If numpreobs > Mdl.P,

simulate uses the latest required number of observations

only.

Columns of Y0 are separate, independent presample paths. The

following conditions apply:

If

Y0is a column vector, it represents a single response path.simulateapplies it to each output path.If

Y0is a matrix,simulateappliesY0(:,to initialize pathj)j.Y0must have at leastNumPathscolumns;simulateuses only the firstNumPathscolumns ofY0.

By default, simulate sets any necessary presample

responses to one of the following values:

The unconditional mean of the model when

Mdlrepresents a stationary AR process without a regression componentZero when

Mdlrepresents a nonstationary process or when it contains a regression component

Data Types: double

Presample innovation data εt used to

initialize either the moving average (MA) component of the ARIMA model or the

conditional variance model, specified as a numpreobs-by-1 numeric

column vector or a numpreobs-by-numprepaths

matrix. Use E0 only when you supply optional data inputs as numeric

arrays.

Each row is a presample observation (sampling time), and measurements in each row

occur simultaneously. The last row contains the latest presample observation.

numpreobs must be at least Mdl.Q to initialize

the MA model component. If Mdl.Variance is a conditional variance

model (for example, a garch model object),

simulate can require more rows than

Mdl.Q. If numpreobs is larger than required,

simulate uses the latest required number of observations

only.

Columns of E0 are separate, independent presample paths. The

following conditions apply:

If

E0is a column vector, it represents a single residual path.simulateapplies it to each output path.If

E0is a matrix,simulateappliesE0(:,to initialize simulating pathj)j.E0must have at leastNumPathscolumns;simulateuses only the firstNumPathscolumns ofE0.

By default, simulate sets the necessary presample

disturbances to zero.

Data Types: double

Presample conditional variance data

σt2 used to

initialize the conditional variance model, specified as a

numpreobs-by-1 positive numeric column vector or a

numpreobs-by-numprepaths positive numeric

matrix. If the conditional variance Mdl.Variance is constant,

simulate ignores V0. Use

V0 only when you supply optional data inputs as numeric

arrays.

Each row is a presample observation (sampling time), and measurements in each row

occur simultaneously. The last row contains the latest presample observation.

numpreobs must be at least Mdl.Q to initialize

the conditional variance model in Mdl.Variance. For details, see

the simulate function of conditional variance

models. If numpreobs is larger than required,

simulate uses the latest required number of observations

only.

Columns of V0 are separate, independent presample paths. The

following conditions apply:

If

V0is a column vector, it represents a single path of conditional variances.simulateapplies it to each output path.If

V0is a matrix,simulateappliesV0(:,to initialize simulating pathj)j.V0must have at leastNumPathscolumns;simulateuses only the firstNumPathscolumns ofV0.

By default, simulate sets all necessary presample

observations to the unconditional variance of the conditional variance process.

Data Types: double

Since R2023b

Residual variable et to select from

Presample containing the presample residual data, specified as

one of the following data types:

String scalar or character vector containing a variable name in

Presample.Properties.VariableNamesVariable index (positive integer) to select from

Presample.Properties.VariableNamesA logical vector, where

PresampleInnovationVariable(selects variablej) = truejPresample.Properties.VariableNames

The selected variable must be a numeric matrix and cannot contain missing values

(NaNs).

If you specify presample residual data by using the Presample

name-value argument, you must specify

PresampleInnovationVariable.

Example: PresampleInnovationVariable="StockRateDist0"

Example: PresampleInnovationVariable=[false false true false] or

PresampleInnovationVariable=3 selects the third table variable as

the presample innovation variable.

Data Types: double | logical | char | cell | string

Since R2023b

Conditional variance variable

σt2 to select

from Presample containing presample conditional variance data,

specified as one of the following data types:

String scalar or character vector containing a variable name in

Presample.Properties.VariableNamesVariable index (positive integer) to select from

Presample.Properties.VariableNamesA logical vector, where

PresampleVarianceVariable(selects variablej) = truejPresample.Properties.VariableNames

The selected variable must be a numeric vector and cannot contain missing values

(NaNs).

If you specify presample conditional variance data by using the

Presample name-value argument, you must specify

PresampleVarianceVariable.

Example: PresampleVarianceVariable="StockRateVar0"

Example: PresampleVarianceVariable=[false false true false] or

PresampleVarianceVariable=3 selects the third table variable as

the presample conditional variance variable.

Data Types: double | logical | char | cell | string

Exogenous predictor data for the regression component in the model, specified as a

numeric matrix with numpreds columns. numpreds

is the number of predictor variables (numel(Mdl.Beta)). Use

X only when you supply optional data inputs as numeric

arrays.

Each row of X corresponds to a period in the length

numobs simulation sample (period for which

simulate simulates observations; the period after the

presample). X must have at least numobs rows.

The last row contains the latest predictor data. If X has more than

numobs rows, simulate uses only the

latest numobs rows.

simulate does not use the regression component in the

presample period.

Columns of X are separate predictor variables.

simulate applies X to each simulated

path; that is, X represents one path of observed predictors.

By default, simulate excludes the regression component,

regardless of its presence in Mdl.

Data Types: double

Note

NaNvalues inX,Y0,E0, andV0indicate missing values.simulateremoves missing values from specified data by list-wise deletion.For the presample,

simulatehorizontally concatenates the possibly jagged arraysY0,E0, andV0with respect to the last rows, and then it removes any row of the concatenated matrix containing at least oneNaN.For in-sample data,

simulateremoves any row ofXcontaining at least oneNaN.

This type of data reduction reduces the effective sample size and can create an irregular time series.

For numeric data inputs,

simulateassumes that you synchronize the presample data such that the latest observations occur simultaneously.simulateissues an error when any table or timetable input contains missing values.

Output Arguments

Simulated response paths yt, returned as a numobs-by-1 numeric column vector or a numobs-by-NumPaths numeric matrix. simulate returns Y by default and when you supply optional data in numeric arrays.

Y represents the continuation of the presample responses in Y0.

Each row corresponds to a period in the simulated series; the simulated series has the periodicity of Mdl. Each column is a separate simulated path.

Simulated conditional variance paths

σt2 of the

mean-zero innovations associated with Y, returned as a

numobs-by-1 numeric column vector or a

numobs-by-NumPaths numeric matrix.

simulate returns V by default and when

you supply optional data in numeric arrays

The dimensions of V correspond to the dimensions of

Y.

Since R2023b

Simulated response yt, innovation

εt, and conditional variance

σt2 paths,

returned as a table or timetable, the same data type as Presample

or InSample. simulate returns

Tbl only when you supply at least one of the inputs

Presample and InSample.

Tbl contains the following variables:

The simulated response paths, which are in a

numobs-by-NumPathsnumeric matrix, with rows representing observations and columns representing independent paths. Each path represents the continuation of the corresponding presample path inPresample, or each path corresponds, in time, with the rows ofInSample.simulatenames the simulated response variable inTblresponseName_ResponseresponseNameMdl.SeriesName. For example, ifMdl.SeriesNameisStockReturns,Tblcontains a variable for the corresponding simulated response paths with the nameStockReturns_Response.The simulated innovation paths, which are in a

numobs-by-NumPathsnumeric matrix, with rows representing observations and columns representing independent paths. Each path represents the continuation of the corresponding presample path inPresample, or each path corresponds, in time, with the rows ofInSample.simulatenames the simulated innovation variable inTblresponseName_InnovationresponseNameMdl.SeriesName. For example, ifMdl.SeriesNameisStockReturns,Tblcontains a variable for the corresponding simulated innovation paths with the nameStockReturns_Innovation.The simulated conditional variance paths, which are in a

numobs-by-NumPathsnumeric matrix, with rows representing observations and columns representing independent paths. Each path represents the continuation of the corresponding presample path inPresample, or each path corresponds, in time, with the rows ofInSample.simulatenames the simulated conditional variance variable inTblresponseName_VarianceresponseNameMdl.SeriesName. For example, ifMdl.SeriesNameisStockReturns,Tblcontains a variable for the corresponding simulated conditional variance paths with the nameStockReturns_Variance.When you supply

InSample,Tblcontains all variables inInSample.

If Tbl is a timetable, the following conditions hold:

The row order of

Tbl, either ascending or descending, matches the row order ofPreample.If you specify

InSample, row timesTbl.TimeareInSample.Time(1:numobs). Otherwise,Tbl.Time(1)is the next time afterPresample(end)relative to the sampling frequency, andTbl.Time(2:numobs)are the following times relative to the sampling frequency.

References

[1] Box, George E. P., Gwilym M. Jenkins, and Gregory C. Reinsel. Time Series Analysis: Forecasting and Control. 3rd ed. Englewood Cliffs, NJ: Prentice Hall, 1994.

[2] Enders, Walter. Applied Econometric Time Series. Hoboken, NJ: John Wiley & Sons, Inc., 1995.

[3] Hamilton, James D. Time Series Analysis. Princeton, NJ: Princeton University Press, 1994.

Version History

Introduced in R2012aIn addition to accepting presample and in-sample predictor data in numeric arrays,

simulate accepts input data in tables or regular timetables. When

you supply input data in a table or timetable, the following conditions apply:

If you specify optional presample response, innovation, or conditional variance data to initialize the model, you must also specify corresponding variable names containing the data to use.

If you specify optional in-sample predictor data for the exogenous regression component of the model, you must also specify corresponding predictor variable names containing the data to use.

simulatereturns results in a table or timetable.

Name-value arguments to support tabular workflows include:

Presamplespecifies the input table or regular timetable of presample innovations and conditional variance data.PresampleResponseVariablespecifies the variable name of the response paths to select fromPresample.PresampleInnovationVariablespecifies the variable name of the innovation paths to select fromPresample.PresampleVarianceVariablespecifies the variable name of the conditional variance paths to select fromPresample.InSamplespecifies the input table or regular timetable of in-sample predictor data.PredictorVariablesspecifies the names of the predictor series to select fromInSamplefor a model regression component.

See Also

Objects

Functions

Topics

- Simulate Stationary Processes

- Simulate Trend-Stationary and Difference-Stationary Processes

- Simulate Multiplicative ARIMA Models

- Simulate Conditional Mean and Variance Models

- Monte Carlo Simulation of Conditional Mean Models

- Presample Data for Conditional Mean Model Simulation

- Transient Effects in Conditional Mean Model Simulations

- Monte Carlo Forecasting of Conditional Mean Models

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Select a Web Site

Choose a web site to get translated content where available and see local events and offers. Based on your location, we recommend that you select: .

You can also select a web site from the following list

How to Get Best Site Performance

Select the China site (in Chinese or English) for best site performance. Other MathWorks country sites are not optimized for visits from your location.

Americas

- América Latina (Español)

- Canada (English)

- United States (English)

Europe

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)