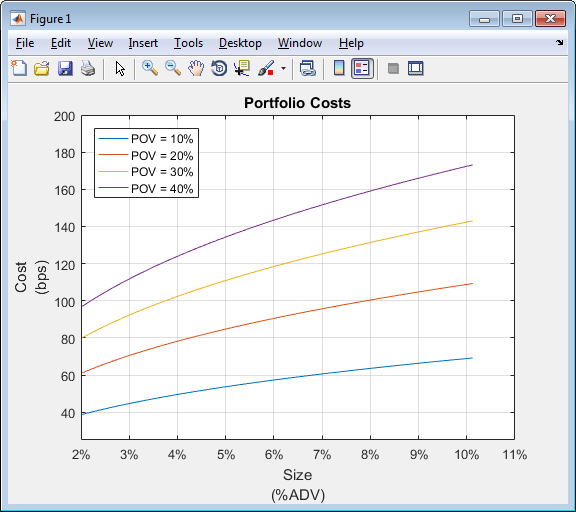

portfolioCostCurves

Estimate market-impact cost of order execution for portfolio

Description

pcc = portfolioCostCurves(k,portfolio,tradeQuantity,tqRange,tradeStrategy,tsRange)

Kissell Research Group (KRG) transaction cost analysis object

kPortfolio data

portfolioTrade quantity

tradeQuantitywith a range of valuestqRangeTrade strategy

tradeStrategywith a range of valuestsRange

Examples

Input Arguments

Output Arguments

Tips

To test multiple portfolio transactions, you can use different ranges. You can change the percentage of shares in the transaction or use a different trade strategy. For details, see Input Arguments.

For details about the calculations, contact Kissell Research Group.

References

[1] Kissell, Robert. “A Practical Framework for Transaction Cost Analysis.” Journal of Trading. Vol. 3, Number 2, Summer 2008, pp. 29–37.

[2] Kissell, Robert. “Algorithmic Trading Strategies.” Ph.D. Thesis. Fordham University, May 2006.

[3] Kissell, Robert. “TCA in the Investment Process: An Overview.” Journal of Index Investing. Vol. 2, Number 1, Summer 2011, pp. 60–64.

[4] Kissell, Robert. The Science of Algorithmic Trading and Portfolio Management. Cambridge, MA: Elsevier/Academic Press, 2013.

[5] Kissell, Robert, and Morton Glantz. Optimal Trading Strategies. New York, NY: AMACOM, Inc., 2003.

Version History

Introduced in R2016a

See Also

krg | costCurves | iStar | marketImpact | timingRisk