Workflow for Expected Shortfall (ES) Backtesting by Du and Escanciano

This example shows the workflow for using the Du-Escanciano (DE) expected shortfall (ES) backtests and demonstrates a fixed test window for a single DE model with multiple VaR levels.

Load Data

The data in the ESBacktestDistributionData.mat file has returns, VaR and ES data, and distribution information for three models: normal, and t with 5 degrees of freedom and t with 10 degrees of freedom. The data spans multiple years from January 1996 to July 2003 and includes a total of 1966 observations.

This example uses a t distribution with 10 degrees of freedom and focuses on one year of data to show the difference between the critical value methods for large-sample approximation and simulation supported by the esbacktestbyde class.

load ESBacktestDistributionData.mat TargetYear = 1998; % Change to test other calendar years Ind = year(Dates)==TargetYear; Dates = Dates(Ind); Returns = Returns(Ind); VaR = T10VaR(Ind,:); ES = T10ES(Ind,:); Mu = 0; % Always 0 in this data set Sigma = T10Scale(Ind);

Plot Data

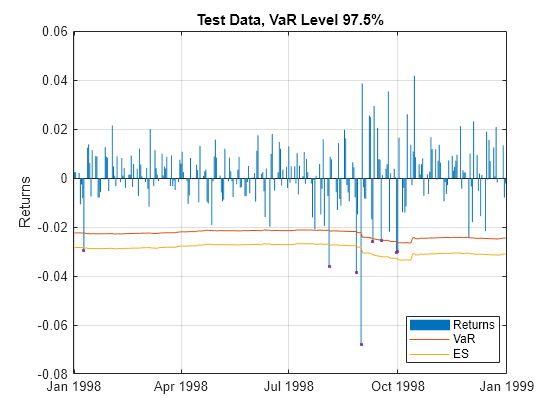

Plot the data for a VaR level of 0.975.

% Plot data TargetVaRLevel = 0.975; VaRInd = VaRLevel==TargetVaRLevel; FailureInd = Returns<-VaR(:,VaRInd); bar(Dates,Returns) hold on plot(Dates,-VaR(:,VaRInd),Dates,-ES(:,VaRInd)) plot(Dates(FailureInd),Returns(FailureInd),'.') hold off legend('Returns','VaR','ES','Location','best') title(['Test Data, VaR Level ' num2str(TargetVaRLevel*100) '%']) ylabel('Returns') grid on

Create an esbacktestbyde Object

Create an esbacktestbyde object to run the DE tests. Note that VaR and ES data are not required inputs because the DE tests work on "mapped returns" or "ranks" and perform mapping by using the distribution information. However, for convenience, the esbacktestbyde object computes the VaR and ES data internally using the distribution information and stores the data in the VaRData and ESData properties of the esbacktestbyde object. The VaR and ES data is used only to estimate the severity ratios reported by the summary function and are not used for any of the DE tests.

By default, when you create a esbacktestbyde object, a simulation runs and large-sample and simulation-based critical values are available immediately. Although the simulation processing is efficient, if you verify that large-sample approximation is appropriate for the sample size and VaR level under consideration, you can turn the simulation off to increase processing speed. To turn off the simulation, when using esbacktestbyde to create an esbacktestbtde object, set the name-value pair argument 'Simulate' to false.

rng('default'); % For reproducibility tic; ebtde = esbacktestbyde(Returns,"t",... 'DegreesOfFreedom',10,... 'Location',Mu,... 'Scale',Sigma,... 'VaRLevel',VaRLevel,... 'PortfolioID',"S&P",... 'VaRID',"t(10)"); toc;

Elapsed time is 0.154847 seconds.

disp(ebtde)

esbacktestbyde with properties:

PortfolioData: [261×1 double]

VaRData: [261×3 double]

ESData: [261×3 double]

Distribution: [1×1 struct]

PortfolioID: "S&P"

VaRID: ["t(10)" "t(10)" "t(10)"]

VaRLevel: [0.9500 0.9750 0.9900]

disp(ebtde.Distribution)

Name: "t"

DegreesOfFreedom: 10

Location: 0

Scale: [261×1 double]

Summary Statistics

Use summary to return a basic expected shortfall (ES) report on failures and severity. This is the same summary output as the other ES backtesting classes esbacktest and esbacktestbysim. When the esbacktestbyde object is created, the VaR and ES data are computed using the distribution information. This information is stored in the VaRData and ESData properties. The summary function uses the VaRData and ESData properties to compute the observed severity ratio.

disp(summary(ebtde))

PortfolioID VaRID VaRLevel ObservedLevel ExpectedSeverity ObservedSeverity Observations Failures Expected Ratio Missing

___________ _______ ________ _____________ ________________ ________________ ____________ ________ ________ ______ _______

"S&P" "t(10)" 0.95 0.94253 1.3288 1.5295 261 15 13.05 1.1494 0

"S&P" "t(10)" 0.975 0.96935 1.2652 1.5269 261 8 6.525 1.2261 0

"S&P" "t(10)" 0.99 0.98467 1.2169 1.5786 261 4 2.61 1.5326 0

Run Tests

Use runtests to run all expected shortfall (ES) backtests for esbacktestbyde object. The default critical value method is 'large-sample' or asymptotic approximation.

disp(runtests(ebtde))

PortfolioID VaRID VaRLevel ConditionalDE UnconditionalDE

___________ _______ ________ _____________ _______________

"S&P" "t(10)" 0.95 accept accept

"S&P" "t(10)" 0.975 accept accept

"S&P" "t(10)" 0.99 accept accept

Run the tests with 'simulation' or finite-sample critical values.

disp(runtests(ebtde,'CriticalValueMethod','simulation'))

PortfolioID VaRID VaRLevel ConditionalDE UnconditionalDE

___________ _______ ________ _____________ _______________

"S&P" "t(10)" 0.95 accept accept

"S&P" "t(10)" 0.975 accept accept

"S&P" "t(10)" 0.99 accept accept

The runtests function accepts the name-value pair argument 'ShowDetails' which includes extra columns in the output. Specifically, this output includes the critical value method used, number of lags, and test confidence level.

disp(runtests(ebtde,'CriticalValueMethod','simulation','ShowDetails',true))

PortfolioID VaRID VaRLevel ConditionalDE UnconditionalDE CriticalValueMethod NumLags TestLevel

___________ _______ ________ _____________ _______________ ___________________ _______ _________

"S&P" "t(10)" 0.95 accept accept "simulation" 1 0.95

"S&P" "t(10)" 0.975 accept accept "simulation" 1 0.95

"S&P" "t(10)" 0.99 accept accept "simulation" 1 0.95

Unconditional DE Test Details

The unconditional DE test assesses the severity of the violations based on an evaluation of the observed average tail loss and determines whether the severity is consistent with the model assumptions. All the tests supported in the related classes esbacktest and esbacktestbysim are also severity tests.

To view the unconditional DE test details, use the unconditionalDE function. By default, this function uses the 'large-sample' critical value method.

disp(unconditionalDE(ebtde))

PortfolioID VaRID VaRLevel UnconditionalDE PValue TestStatistic LowerCI UpperCI Observations CriticalValueMethod MeanLS StdLS Scenarios TestLevel

___________ _______ ________ _______________ ________ _____________ _________ ________ ____________ ___________________ ______ _________ _________ _________

"S&P" "t(10)" 0.95 accept 0.31715 0.032842 0.0096343 0.040366 261 "large-sample" 0.025 0.0078398 NaN 0.95

"S&P" "t(10)" 0.975 accept 0.32497 0.018009 0.0015295 0.023471 261 "large-sample" 0.0125 0.0055973 NaN 0.95

"S&P" "t(10)" 0.99 accept 0.076391 0.011309 0 0.011978 261 "large-sample" 0.005 0.0035603 NaN 0.95

To compare the results of 'large-sample' to simulation-based critical values, use the name-value pair argument 'CriticalValueMethod'. In this example, the results of both critical value methods, including the confidence interval and the p-values, look similar.

disp(unconditionalDE(ebtde,'CriticalValueMethod','simulation'))

PortfolioID VaRID VaRLevel UnconditionalDE PValue TestStatistic LowerCI UpperCI Observations CriticalValueMethod MeanLS StdLS Scenarios TestLevel

___________ _______ ________ _______________ ______ _____________ _________ ________ ____________ ___________________ ______ _____ _________ _________

"S&P" "t(10)" 0.95 accept 0.326 0.032842 0.010859 0.041709 261 "simulation" NaN NaN 1000 0.95

"S&P" "t(10)" 0.975 accept 0.336 0.018009 0.0032446 0.024657 261 "simulation" NaN NaN 1000 0.95

"S&P" "t(10)" 0.99 accept 0.126 0.011309 0 0.013311 261 "simulation" NaN NaN 1000 0.95

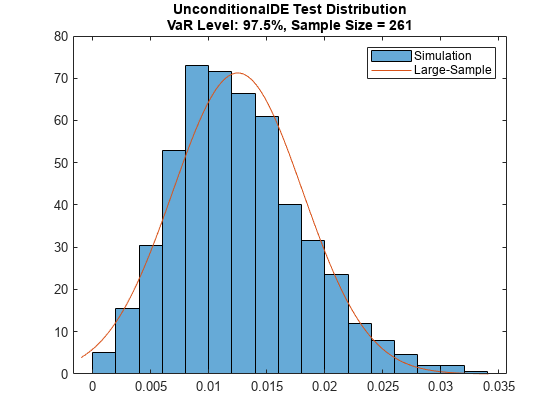

You can visualize the 'simulation' and 'large-sample' distributions to assess whether the 'large-sample' approximation is accurate enough for the sample size and VaR level under consideration. The unconditionalDE function returns the 'simulated' test statistics as an optional output.

In this example, higher VaR levels cause a noticeable mismatch between the 'large-sample' and 'simulation' distributions. However, the confidence intervals and p-values are comparable.

% Choose VaR level TargetVaRLevel = 0.975; VaRInd = VaRLevel==TargetVaRLevel; [~,s] = unconditionalDE(ebtde,'CriticalValueMethod','simulation'); histogram(s(VaRInd,:),'Normalization',"pdf") hold on t = unconditionalDE(ebtde,'CriticalValueMethod','large-sample'); Mu = t.MeanLS(VaRInd); Sigma = t.StdLS(VaRInd); MinValPlot = min(s(VaRInd,:))-0.001; MaxValPlot = max(s(VaRInd,:))+0.001; xLS = linspace(MinValPlot,MaxValPlot,101); pdfLS = normpdf(xLS,Mu,Sigma); plot(xLS,pdfLS) hold off legend({'Simulation','Large-Sample'}) Title = sprintf('UnconditionalDE Test Distribution\nVaR Level: %g%%, Sample Size = %d',VaRLevel(VaRInd)*100,t.Observations(VaRInd)); title(Title)

Conditional DE Test Details

The conditional DE test assesses whether there is evidence of autocorrelation in the tail losses.

Although the names are similar, the conditional DE test and the conditional test supported in esbacktestbysim are qualitatively different tests. The conditional Acerbi-Szekely test supported in esbacktestbysim tests the severity of the ES, conditional on whether the model passes a VaR test. The Acerbi-Szekely conditional test is a severity test, comparable to the tests supported in esbacktest, esbacktestbysim, and the unconditionalDE test.

However, the conditional DE test in esbacktestbyde is a test for independence across time periods.

To see the details of the conditional DE test results, use the conditionalDE function. By default, this function uses the 'large-sample' critical value method and tests for one lag (correlation with the previous time period).

disp(conditionalDE(ebtde))

PortfolioID VaRID VaRLevel ConditionalDE PValue TestStatistic CriticalValue AutoCorrelation Observations CriticalValueMethod NumLags Scenarios TestLevel

___________ _______ ________ _____________ _______ _____________ _____________ _______________ ____________ ___________________ _______ _________ _________

"S&P" "t(10)" 0.95 accept 0.45361 0.5616 3.8415 0.046387 261 "large-sample" 1 NaN 0.95

"S&P" "t(10)" 0.975 accept 0.54189 0.37205 3.8415 0.037755 261 "large-sample" 1 NaN 0.95

"S&P" "t(10)" 0.99 accept 0.87949 0.022989 3.8415 -0.0093851 261 "large-sample" 1 NaN 0.95

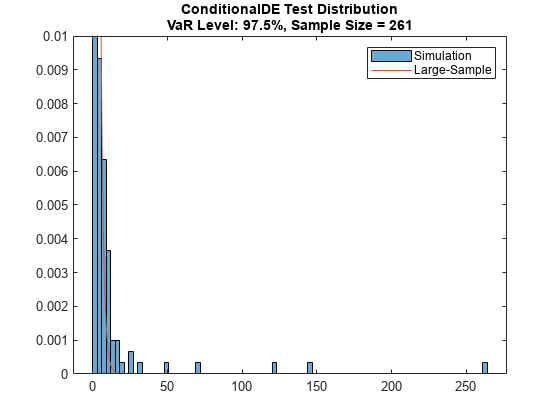

The results of the 'large-sample' critical value method, particularly the simulation critical values and p-values, differ substantially from the results of the 'simulation' critical value method.

The critical value is similar for a 95% VaR level, but the simulation-based critical value is much larger for higher VaR levels, especially for a 99% VaR. The autocorrelation is 1 for any sample without VaR failures. Therefore, the test statistic equals the number of observations for any scenario without VaR failures. For a 99% VaR level, scenarios without VaR failures are like; consequently, there is a mass point at the number of observations which appears as a long, heavy tail in the simulated distribution of the test statistic.

disp(conditionalDE(ebtde,'CriticalValueMethod','simulation'))

PortfolioID VaRID VaRLevel ConditionalDE PValue TestStatistic CriticalValue AutoCorrelation Observations CriticalValueMethod NumLags Scenarios TestLevel

___________ _______ ________ _____________ ______ _____________ _____________ _______________ ____________ ___________________ _______ _________ _________

"S&P" "t(10)" 0.95 accept 0.257 0.5616 3.6876 0.046387 261 "simulation" 1 1000 0.95

"S&P" "t(10)" 0.975 accept 0.141 0.37205 5.3504 0.037755 261 "simulation" 1 1000 0.95

"S&P" "t(10)" 0.99 accept 0.502 0.022989 261 -0.0093851 261 "simulation" 1 1000 0.95

You can visually compare the 'large-sample' and 'simulation' distributions. The conditionalDE function also returns the simulated test statistics as an optional output.

Notice that the tail of the distribution gets heavier as the VaR level increases.

% Choose VaR level TargetVaRLevel = 0.975; VaRInd = VaRLevel==TargetVaRLevel; [t,s] = conditionalDE(ebtde,'CriticalValueMethod','simulation'); xLS = 0:0.01:20; pdfLS = chi2pdf(xLS,t.NumLags(1)); histogram(s(VaRInd,:),'Normalization',"pdf") hold on plot(xLS,pdfLS) hold off ylim([0 0.01]) legend({'Simulation','Large-Sample'}) Title = sprintf('ConditionalDE Test Distribution\nVaR Level: %g%%, Sample Size = %d',VaRLevel(VaRInd)*100,t.Observations(VaRInd)); title(Title)

Because the conditional DE test is based on autocorrelations, you can run the test for differing numbers of lags.

Run the conditional DE test for 2 lags. At a VaR level of 99%, the 'large-sample' critical value method rejects the model but the 'simulation' critical value method does not reject the model, with a p-value close to 10%. This shows that the 'simulation' distribution and the 'large-sample' approximation can lead to different results, depending on the sample size and VaR level.

disp(conditionalDE(ebtde,'NumLags',2,'CriticalValueMethod','large-sample'))

PortfolioID VaRID VaRLevel ConditionalDE PValue TestStatistic CriticalValue AutoCorrelation Observations CriticalValueMethod NumLags Scenarios TestLevel

___________ _______ ________ _____________ __________ _____________ _____________ _______________ ____________ ___________________ _______ _________ _________

"S&P" "t(10)" 0.95 reject 0.015812 8.294 5.9915 0.17212 261 "large-sample" 2 NaN 0.95

"S&P" "t(10)" 0.975 reject 0.00045758 15.379 5.9915 0.23979 261 "large-sample" 2 NaN 0.95

"S&P" "t(10)" 0.99 reject 2.5771e-07 30.343 5.9915 0.34083 261 "large-sample" 2 NaN 0.95

disp(conditionalDE(ebtde,'NumLags',2,'CriticalValueMethod','simulation'))

PortfolioID VaRID VaRLevel ConditionalDE PValue TestStatistic CriticalValue AutoCorrelation Observations CriticalValueMethod NumLags Scenarios TestLevel

___________ _______ ________ _____________ ______ _____________ _____________ _______________ ____________ ___________________ _______ _________ _________

"S&P" "t(10)" 0.95 reject 0.03 8.294 6.1397 0.17212 261 "simulation" 2 1000 0.95

"S&P" "t(10)" 0.975 reject 0.019 15.379 9.3364 0.23979 261 "simulation" 2 1000 0.95

"S&P" "t(10)" 0.99 accept 0.098 30.343 522 0.34083 261 "simulation" 2 1000 0.95

Running a New Simulation with simulate

If a p-value is near a rejection boundary, you can run a new simulation to request more scenarios to reduce a simulation error.

You can also run a new simulation to request a higher number of lags. By default, creating an esbacktestbyde object causes the simulation to run so that the simulation test results are available immediately. However, to avoid extra storage, only 5 lags are simulated. If you request more than 5 lags with the simulate function, the conditionalDE test function displays the following message:

No simulation results available for the number of lags requested. Call 'simulate' with the desired number of lags.

You first need to run a new simulation using esbacktestbyde and specify the number of lags to use for that simulation. Displaying the size of the esbacktestbyde object before and after the new simulation illustrates how simulating with more lags increases the amount of data stored in the esbacktestbyde object, as more simulated test statistics are stored with more lags.

% See bytes before new simulation, 5 lags stored whos ebtde

Name Size Bytes Class Attributes ebtde 1x1 164751 esbacktestbyde

% Simulate 6 lags rng('default'); % for reproducibility ebtde = simulate(ebtde,'NumLags',6); % See bytes after new simulation, 6 lags stored whos ebtde

Name Size Bytes Class Attributes ebtde 1x1 188759 esbacktestbyde

After you run a new simulation with esbacktestbyde that increases the number of lags to 6, the test results for conditionalDE are available for the 'simulation' method using 6 lags.

disp(conditionalDE(ebtde,'NumLags',6,'CriticalValueMethod','simulation'))

PortfolioID VaRID VaRLevel ConditionalDE PValue TestStatistic CriticalValue AutoCorrelation Observations CriticalValueMethod NumLags Scenarios TestLevel

___________ _______ ________ _____________ ______ _____________ _____________ _______________ ____________ ___________________ _______ _________ _________

"S&P" "t(10)" 0.95 accept 0.136 9.5173 16.412 -0.022881 261 "simulation" 6 1000 0.95

"S&P" "t(10)" 0.975 accept 0.086 15.854 21.299 -0.021864 261 "simulation" 6 1000 0.95

"S&P" "t(10)" 0.99 accept 0.128 30.438 1566 -0.0096211 261 "simulation" 6 1000 0.95

Alternatively, the conditionalDE test results are always available for the 'large-sample' method for any number of lags.

disp(conditionalDE(ebtde,'NumLags',10,'CriticalValueMethod','large-sample'))

PortfolioID VaRID VaRLevel ConditionalDE PValue TestStatistic CriticalValue AutoCorrelation Observations CriticalValueMethod NumLags Scenarios TestLevel

___________ _______ ________ _____________ __________ _____________ _____________ _______________ ____________ ___________________ _______ _________ _________

"S&P" "t(10)" 0.95 reject 0.018711 21.361 18.307 0.15415 261 "large-sample" 10 NaN 0.95

"S&P" "t(10)" 0.975 accept 0.088587 16.406 18.307 0.027955 261 "large-sample" 10 NaN 0.95

"S&P" "t(10)" 0.99 reject 0.00070234 30.526 18.307 -0.0092432 261 "large-sample" 10 NaN 0.95

See Also

esbacktestbyde | esbacktest | esbacktestbysim | varbacktest

Topics

- VaR Backtesting Workflow

- Value-at-Risk Estimation and Backtesting

- Expected Shortfall (ES) Backtesting Workflow with No Model Distribution Information

- Expected Shortfall (ES) Backtesting Workflow Using Simulation

- Expected Shortfall Estimation and Backtesting

- Rolling Windows and Multiple Models for Expected Shortfall (ES) Backtesting by Du and Escanciano