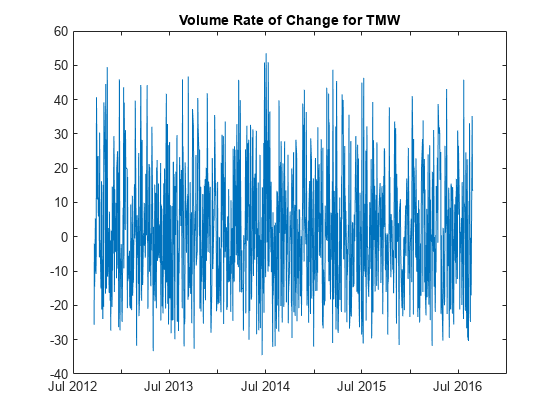

volroc

Volume rate of change

Description

volumeChangeRate = volroc(Data)

volumeChangeRate = volroc(___,Name,Value)

Examples

Input Arguments

Name-Value Arguments

Output Arguments

More About

References

[1] Achelis, S. B. Technical Analysis from A to Z. Second Edition. McGraw-Hill, 1995, pp. 310–311.