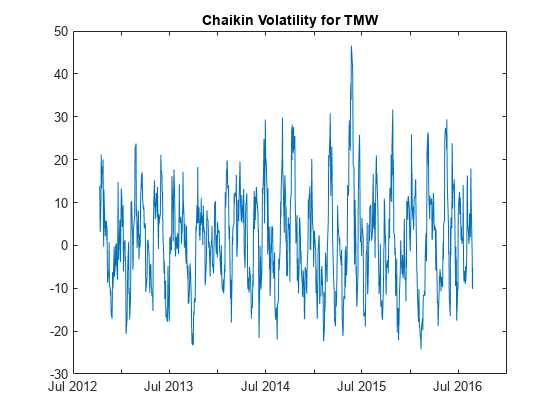

chaikvolat

Chaikin volatility

Description

volatility = chaikvolat(Data)

volatility = chaikvolat(___,Name,Value)

Examples

Input Arguments

Name-Value Arguments

Output Arguments

More About

References

[1] Achelis, S. B. Technical Analysis from A to Z. Second Edition. McGraw-Hill, 1995, pp. 304–305.