Estimate Portfolio Liquidation Costs

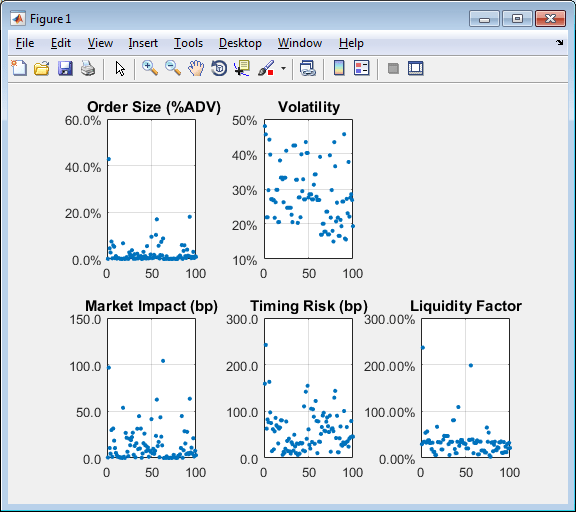

This example shows how to determine the cost of liquidating individual stocks in a portfolio using transaction cost analysis from the Kissell Research Group. Compare the individual stocks in a portfolio using various metrics in a scatter plot.

The example data uses the percentage of volume trade strategy to calculate costs. You can also use the trade time trade strategy to run the analysis by replacing the percentage of volume data with trade time data.

To access the example code, enter edit

KRGPortfolioLiquidityExample.m at the command line.

Retrieve Market-Impact Parameters and Load Transaction Data

Retrieve the market-impact data from the Kissell Research Group FTP site.

Connect to the FTP site using the ftp function with a user

name and password. Navigate to the MI_Parameters folder and

retrieve the market-impact data in the

MI_Encrypted_Parameters.csv file.

miData contains the encrypted market-impact date, code,

and parameters.

f = ftp('ftp.kissellresearch.com','username','pwd'); mget(f,'MI_Encrypted_Parameters.csv'); close(f) miData = readtable('MI_Encrypted_Parameters.csv','delimiter', ... ',','ReadRowNames',false,'ReadVariableNames',true);

Create a Kissell Research Group transaction cost analysis object

k.

k = krg(miData);

Load the example data TradeData from the file

KRGExampleData.mat, which is included with the

Datafeed Toolbox™.

load KRGExampleData.mat TradeData

For a description of the example data, see Interpret Variables in Kissell Research Group Data Sets.

Estimate Trading Costs

Estimate market-impact costs mi.

TradeData.mi = marketImpact(k,TradeData);

Estimate the timing risk tr.

TradeData.tr = timingRisk(k,TradeData);

Estimate the liquidity factor lf.

TradeData.lf = liquidityFactor(k,TradeData);

For details about the preceding calculations, contact the Kissell Research Group.

Display Portfolio Plots

Create a scatter plot that shows the following:

Size

Volatility

Market impact

Timing risk

Liquidity factor

figure axOrder = subplot(2,3,1); nSymbols = 1:length(TradeData.Size); scatter(nSymbols,TradeData.Size*100,10,'filled') grid on box on title(' Order Size (%ADV)') axOrder.YAxis.TickLabelFormat = '%.1f%%'; axVolatility = subplot(2,3,2); scatter(nSymbols,TradeData.Volatility*100,10,'filled') grid on box on title('Volatility') axVolatility.YAxis.TickLabelFormat = '%g%%'; axMI = subplot(2,3,4); scatter(nSymbols,TradeData.mi,10,'filled') grid on box on title('Market Impact (bp)') axMI.YAxis.TickLabelFormat = '%.1f'; axTR = subplot(2,3,5); scatter(nSymbols,TradeData.tr,10,'filled') grid on box on title('Timing Risk (bp)') axTR.YAxis.TickLabelFormat = '%.1f'; axLF = subplot(2,3,6); scatter(nSymbols,TradeData.lf*100,10,'filled') grid on box on title('Liquidity Factor') axLF.YAxis.TickLabelFormat = '%.2f%%';

This figure demonstrates a snapshot view into the trading and liquidation

costs, volatility, and size of the stocks in the portfolio. You can modify this

scatter plot to include other variables from

TradeData.

See Also

krg | marketImpact | timingRisk | liquidityFactor