Conduct Stress Test on Portfolio

This example shows how to conduct a stress test on a set of stocks using transaction cost analysis from the Kissell Research Group.

Estimate historical market-impact costs and the corresponding dollar values for the specified date range.

Use trading costs to screen stocks in a portfolio and estimate the cost to liquidate or purchase a specified number of shares.

Analyze trading costs during volatile periods of time such as a financial crisis, flash crash, or debt crisis.

To access the example code, enter edit

KRGStressTestingExample.m at the command line.

Retrieve Market-Impact Parameters and Load Historical Data

Retrieve the market-impact data from the Kissell Research Group FTP site.

Connect to the FTP site using the ftp function with a user

name and password. Navigate to the MI_Parameters folder and

retrieve the market-impact data in the

MI_Encrypted_Parameters.csv file.

miData contains the encrypted market-impact date, code,

and parameters.

f = ftp('ftp.kissellresearch.com','username','pwd'); mget(f,'MI_Encrypted_Parameters.csv'); close(f) miData = readtable('MI_Encrypted_Parameters.csv','delimiter', ... ',','ReadRowNames',false,'ReadVariableNames',true);

Load the example data TradeDataStressTest from the file

KRGExampleData.mat, which is included with the

Datafeed Toolbox™.

load KRGExampleData TradeDataStressTest

For a description of the example data, see Interpret Variables in Kissell Research Group Data Sets.

Create a Kissell Research Group transaction cost analysis object

k. Specify initial settings for the date, market-impact

code, and number of trading days.

k = krg(miData,datetime('today'),1,250);Prepare Data for Stress Testing

Specify the date range from May 1, 2015, through July 31, 2015.

startDate = '5/1/2015'; endDate = '7/31/2015';

Determine the number of stocks numStocks in the portfolio.

Create a date range dateRange from the specified dates. Find

the number of days numDates in the date range.

numStocks = length(TradeDataStressTest.Symbol); dateRange = (datenum(startDate):datenum(endDate))'; numDates = length(dateRange);

Preallocate the output data table o.

outLength = numStocks*numDates; symbols = TradeDataStressTest.Symbol(:,ones(1,numDates)); sides = TradeDataStressTest.Side(:,ones(1,numDates)); dates = dateRange(:,ones(1,numStocks))'; o = table(symbols(:),sides(:),dates(:),NaN(outLength,1),NaN(outLength,1), ... 'VariableNames',{'Symbol','Side','Date','MI','MIDollar'});

Ensure that the number of shares is a positive value using the

abs function.

TradeDataStressTest.Shares = abs(TradeDataStressTest.Shares);

Convert trade time trade strategy to the percentage of volume trade strategy.

TradeDataStressTest.TradeTime = TradeDataStressTest.TradeTime ... .* TradeDataStressTest.ADV; TradeDataStressTest.POV = krg.tradetime2pov(TradeDataStressTest.TradeTime, ... TradeDataStressTest.Shares);

Conduct Stress Test by Estimating Historical Market-Impact Costs

Estimate the historical market-impact costs for each stock in the portfolio

for the date range using marketImpact. Convert

market-impact cost from decimal into local dollars. Retrieve the resulting data

in the output data table o.

kk = 1; for ii = dateRange(1):dateRange(end) for jj = 1:numStocks k.MiCode = TradeDataStressTest.MICode(jj); k.MiDate = ii; o.MI(kk) = marketImpact(k,TradeDataStressTest(jj,:)); o.MIDollar(kk) = (TradeDataStressTest.Shares(jj) ... * TradeDataStressTest.Price(jj)) ... * o.MI(kk) /10000 * TradeDataStressTest.FXRate(jj); kk = kk + 1; end end

Display the first three rows of output data.

o(1:3,:)

ans =

Symbol Side Date MI MIDollar

______ ____ _________ _____ ________

'A' 1.00 736085.00 3.84 384.31

'B' 1.00 736085.00 11.43 14292.24

'C' 1.00 736085.00 32.69 20430.65The output data contains these variables:

Stock symbol

Side

Historical trade date

Historical market-impact cost in basis points

Historical market-impact value in local dollars

Retrieve the daily market-impact cost dailyCost. Determine

the number of days numDays in the output data. Loop through

the data and sum the market-impact costs for individual stocks for each

day.

numDays = length(o.Date)/numStocks; idx = 1; for i = 1:numDays dailyCost.Date(i) = o.Date(idx); dailyCost.DailyMiCost(i) = sum(o.MI(idx:idx+(numStocks-1))); idx = idx+numStocks; end

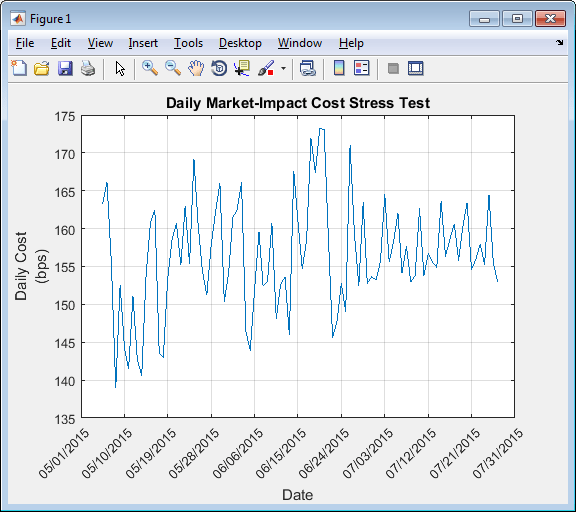

Display the daily market-impact cost in the specified date range. This figure demonstrates how market-impact costs change over time.

plot(b.Date,b.DailyMiCost)

ylabel({'Daily Cost','(bps)'})

title('Daily Market-Impact Cost Stress Test')

xlabel('Date')

grid on

xData = linspace(b.Date(1),b.Date(92),11);

a = gca;

a.XAxis.TickLabels = datestr(xData,'mm/dd/yyyy');

a.XTickLabelRotation = 45;

References

[1] Kissell, Robert. “Creating Dynamic Pre-Trade Models: Beyond the Black Box.” Journal of Trading. Vol. 6, Number 4, Fall 2011, pp. 8–15.

[2] Kissell, Robert. “TCA in the Investment Process: An Overview.” Journal of Index Investing. Vol. 2, Number 1, Summer 2011, pp. 60–64.

[3] Kissell, Robert. The Science of Algorithmic Trading and Portfolio Management. Cambridge, MA: Elsevier/Academic Press, 2013.

[4] Chung, Grace and Robert Kissell. “An Application of Transaction Costs in the Portfolio Optimization Process.” Journal of Trading. Vol. 11, Number 2, Spring 2016, pp. 11–20.