Advanced Risk and Portfolio Management: A (Very) Visual Introduction

Attilio Meucci, ARPM

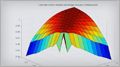

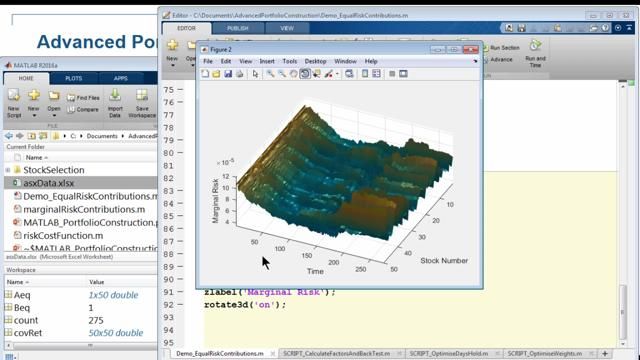

In this session, we discuss with few words and many visualizations several advanced quantitative techniques for the buy side.

Topics include:

- Fully flexible probabilities: VaR is not one single number

- Entropy-pooling conditioning: stress-testing is not certain

- Bayesian ensemble learning: in the end, what do we do?

We also discuss multivariate Bayesian statistics, random matrix theory, robust estimation, and projection of risk to arbitrary horizons (with pitfalls).

Recorded: 23 May 2013