Alicorp Develops a Risk Management Framework to Handle Price Volatility for Commodities

The Solution Enables a More Comprehensive Assessment of Market Volatility

“MATLAB is allowing us to develop our financial models for a fast time to market, enabling us to expose our models to many teams through MATLAB Production Server.”

Key Outcomes

- Enabled market-responsive derivatives valuation in seconds instead of hours using financial models developed with MATLAB, decreasing risk and saving money

- Streamlined the construction, maintenance, implementation, and deployment of financial risk models, decreasing time and resource investment

- Increased user accessibility by enabling reuse and distribution of code through libraries and applications

Alicorp is the largest consumer goods company in Peru, with operations spanning Latin America. A significant portion of its business depends on manufacturing food products from agricultural commodities such as wheat and soybeans, which have highly volatile prices. To minimize this price volatility, Alicorp processes derivatives—a combination of futures, along with both vanilla and exotic options—to make informed buying decisions and for hedging purposes.

The method Alicorp initially used to process derivatives was time-consuming, involving valuing financial derivatives daily with Excel® macros connected to an SQL Server® database. Evaluations took longer with the increasing complexity of derivatives, sometimes taking several hours. Moreover, each change in production required programming a different model, making the team defer improvements. In the volatile market that Alicorp trades in, such delays can be expensive.

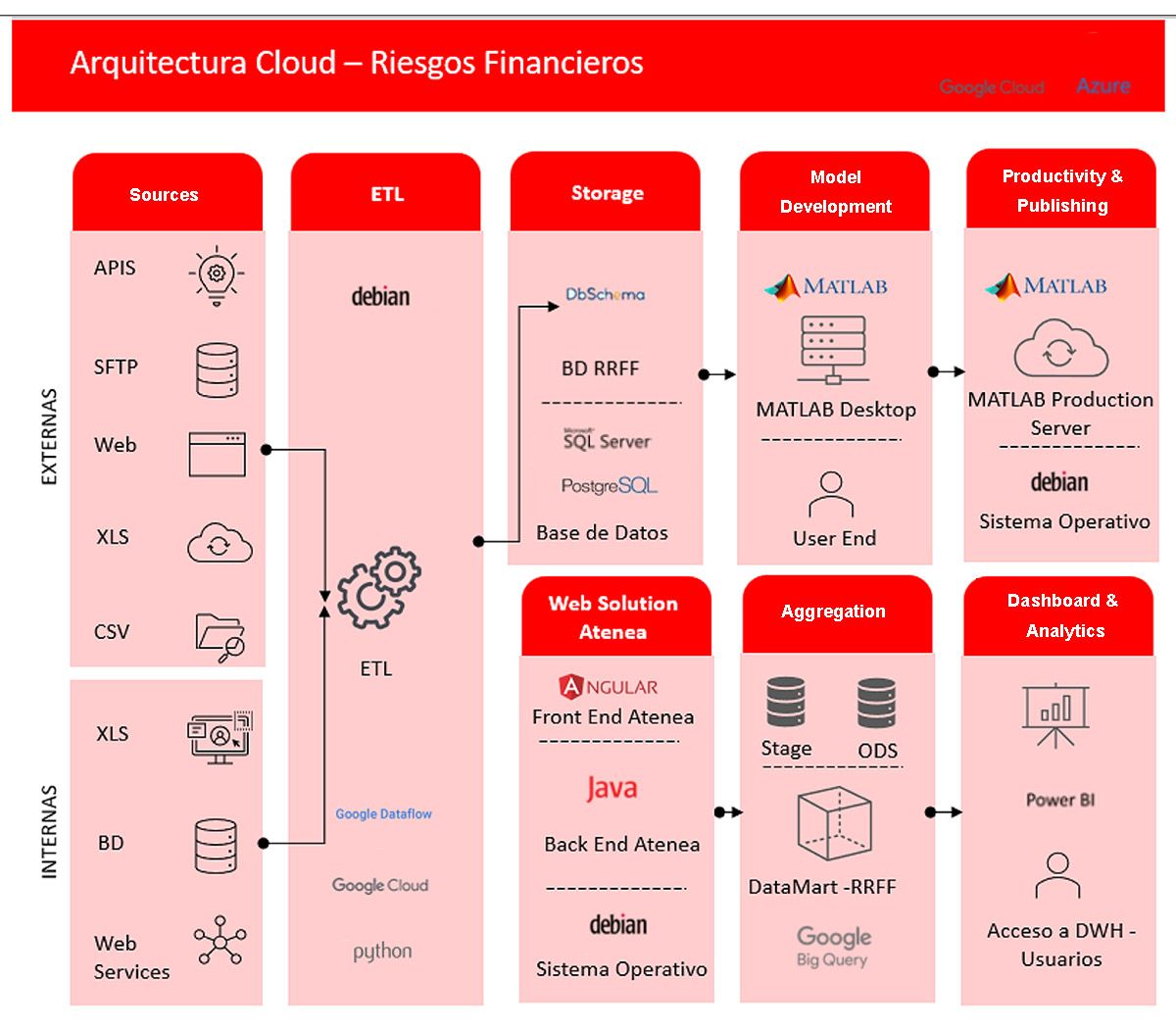

To make model development more agile, Alicorp customized and incorporated proven libraries related to financial risk from MATLAB® into a service-oriented architecture. Its solution, known as Atenea, responds faster to market variations and incorporates a greater variety of derivatives into its models. With support from MathWorks, Alicorp connected in-house financial risk models built in MATLAB with its web-based risk management platform.

Today, Alicorp leans on an inventory of models deployed on MATLAB Production Server™, which enables more comprehensive and real-time risk vetting.

Related Resources